A superyacht's weekly spend

Showcasing a snapshot of data that highlights the amount that superyachts spend during an average week…

Yesterday it was announced that, following a period of tight restrictions, Thailand will be opening up to superyachts once again. However, it wasn’t until earlier in the year (February 2021) that foreign-flagged superyachts were actually able to effectively charter in Thailand, hampering the nation’s ability to grow its superyacht industry. Part of the issue experienced by Thailand and various other nations around the globe is that industry stakeholders have struggled to prove the value of the superyacht industry. Herein we look at a snapshot of data created by The Superyacht Agency for a Pacific island to prove the value of visiting superyachts.

The temptation on the part of global taxation authorities has always been to tax owners a percentage of the value of the hull to import the vessel and use it for commercial purposes. While this seems like an appealing and relatively easy way to generate tax revenue, with the added bonus of the government being seen to tax the rich, in reality, this has just led owners, captains and various other interested parties to avoid the nations with draconian importation requirements and to opt for chartering the yacht in a more convenient location. The key then has been to show these governments what revenue they have been missing out on.

A superyacht’s spend will of course vary from location to location, by the size of the vessel and depending on the time of year. It is important to note, therefore, that the spending figures herein were determined for a small island nation and cannot simply be applied to anywhere at any given time, they compare the difference in weekly spend for 30-40m superyachts and 50-60m superyachts. For a more detailed breakdown of superyacht spending across all size ranges or a data set that applies to a particular location, please contact The Superyacht Agency.

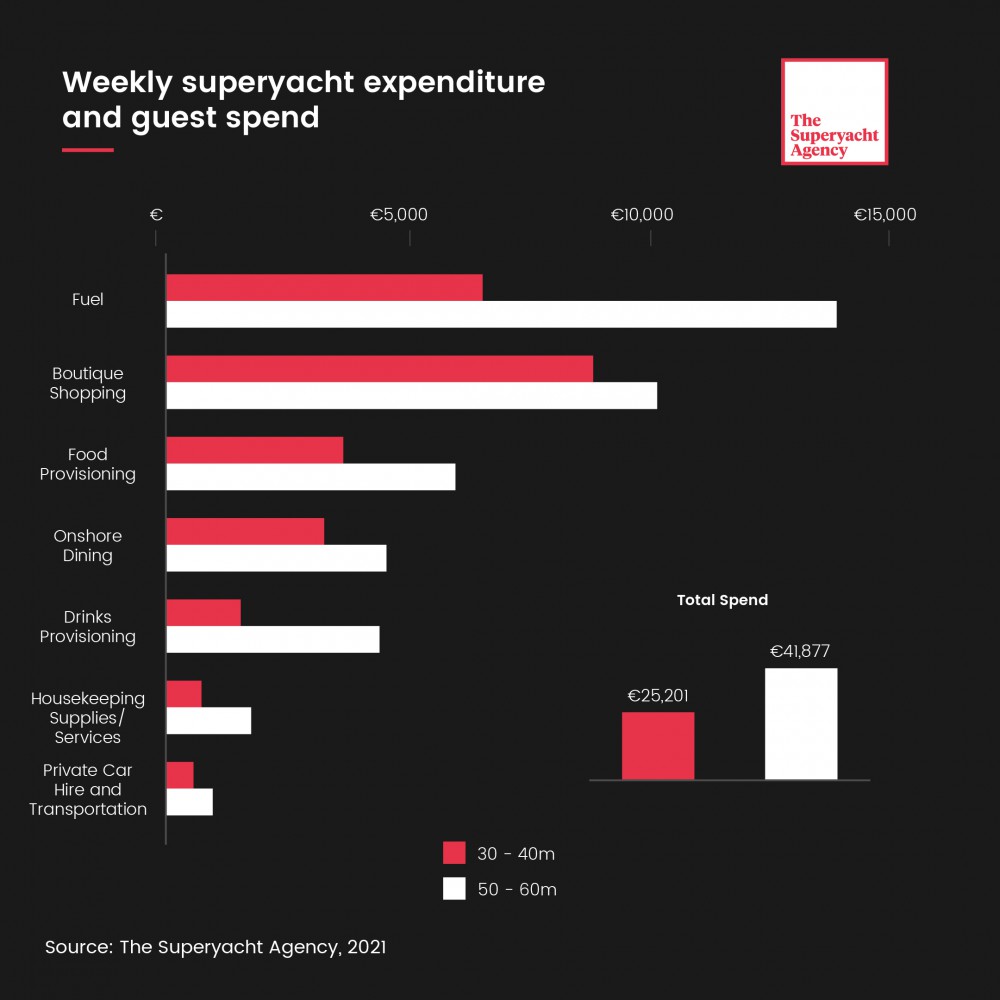

On average, a 30-40m superyacht visiting a small island nation will spend €25,201 per week on operational costs and guest expenditure, with boutique shopping and fuel accounting for the two largest single expenditures. Indeed, fuel and boutique shopping are also the two largest expenditures for larger vessels in the 50-60m range (but reversed in their order), albeit all expenditures have unsurprisingly grown in value significantly. Fuel more than doubles from €6,577 to €13,949 while boutique shopping grows by a far less significant amount. The total weekly operational and guest spend of a 50-60m superyacht increases to €41,877.

How costs are ordered between the two size ranges does not vary except between boutique shopping and fuel, with both size categories showcasing the same order of expenses from most expensive to least. The least significant costs are accounted for by private car hire and transportation, as well as housekeeping supplies and services.

It is not just guests and operational expenses, however, that contribute to superyachts' overall expenditure and increasingly facilities, whether they are summer destinations or hubs for wintering, have started to pay attention to the role of crew. There are a number of reasons to factor crew into any policies or investment strategies to increase superyacht traffic.

For a start, people often underestimate the influence that crew have on the popularity of wintering destinations in particular. Given that owners and captains are eager to keep their best crew on board, a location that caters to the various needs of superyacht crew, provided the costs are not exorbitant, will always be preferable to a location that the crew find unenjoyable. Secondly, if crew enjoy a location, they are far more likely to spend their money locally.

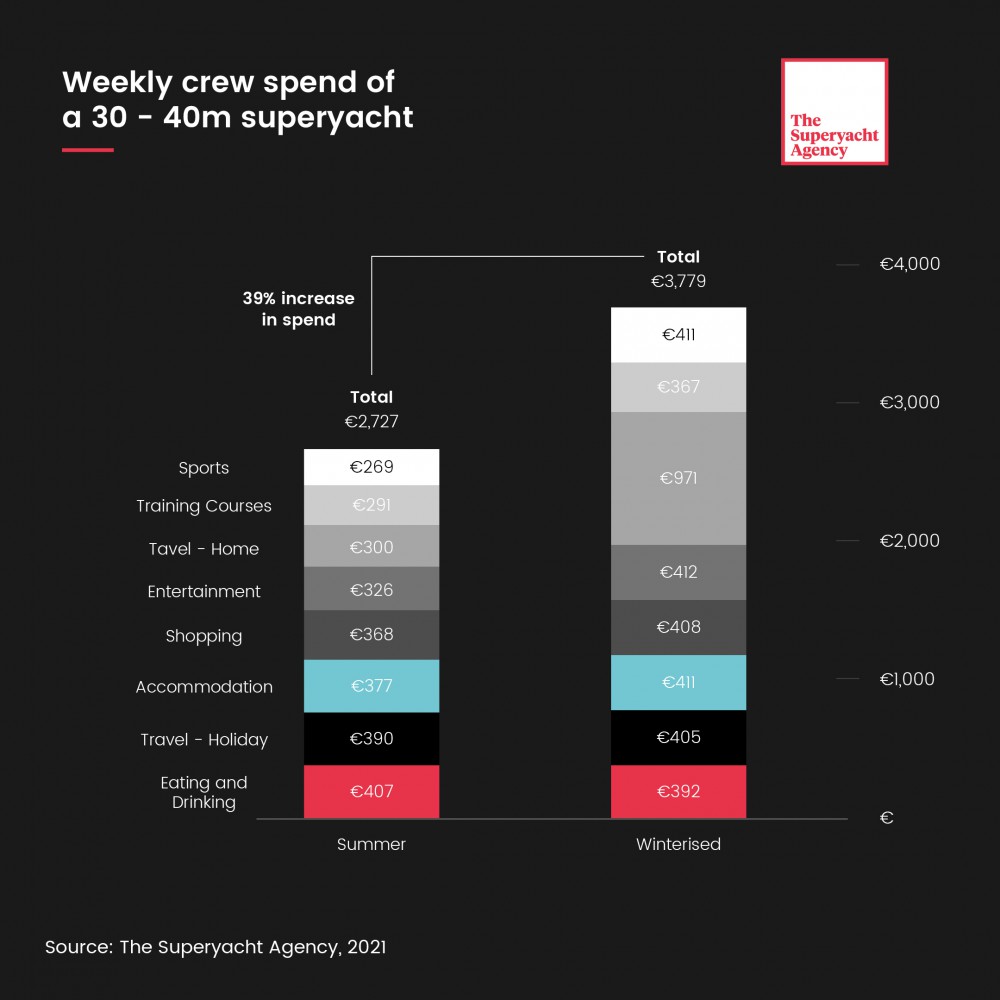

According to our data, the average crew on a 30-40m superyacht will spend €2,727 weekly during the summer and €3,779 during winterised periods. In the first instance, the greatest expenditure is on eating and drinking with the least amount of money spent on training courses. Expenditures increase across the board in winter (except for eating and drinking) no doubt as a result of the crew having more by way of free time and no guests or owners to worry about on board. The single greatest expenditure during the winter is on travel and home visits.

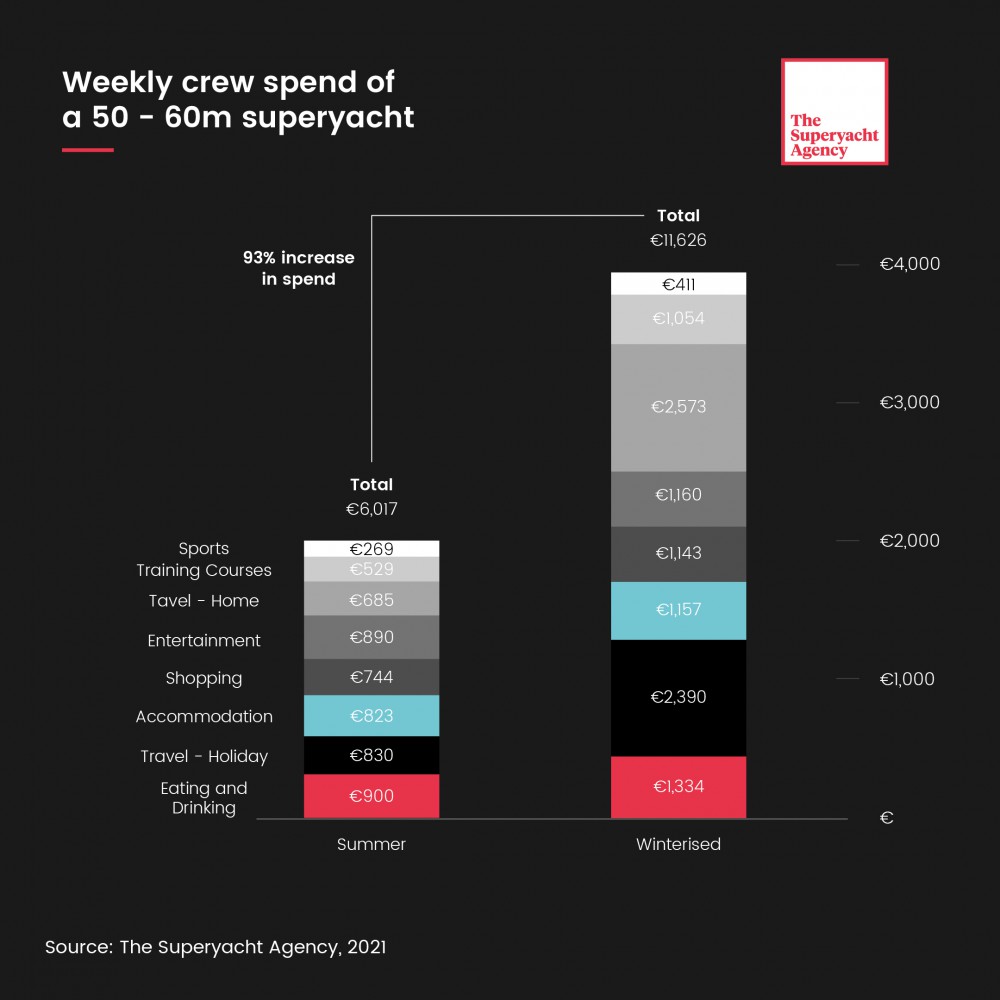

As one would expect, the amount spent by crew across both winter and summer periods increases significantly as the vessel size increase. Naturally, this growth is spurred on by the fact that there will be more crew on board the vessel. Indeed, the average weekly spend for the crew on board a 50-60m superyacht jumps up to €6,017 in the summer and €11,626 in winter. The amount that superyacht crew contribute to local communities is significant and, thus, more and more regions and facilities are taking heed of the impact of superyacht crew.

In order for governments or investors to make significant changes to yachting infrastructure or policy, they must have access to investable data. Being able to prove the benefit of superyacht business has helped regions like Thailand, Australia and others to develop their policies and grow their superyacht markets.

A superyacht's average weekly spend obviously only forms a small part of the entire data puzzle. The real strength of consultancy is when data sats become overlayed with one another to create a clear picture of strengths, opportunities and weaknesses. Overlaying average spending data with migratory data, for instance, creates a powerful resource. For more data relating to economic investment strategy, click here to contact The Superyacht Agency.

For more information on what The Superyacht Agency can do for your business, click here.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Mutual benefit

How a focus on superyacht crew welfare yields benefits for all involved and risks for employers if ignored

Crew

Thailand lifts travel restrictions for yachts

The eventual reopening of Thailand is scheduled to take place on 1 November

Owner

Palumbo Group to support supply chain

Palumbo Group joins Crédit Agricole Italia’s supply chain finance platform

Business

Unprecedented number of new buyers

The future looks bright with the boom period significantly characterised by new entrants to the market

Owner

Reflections on MYS 2021

As MYS enters its next phase of development, a buoyant market eases its transition

Business

Perini Navi in €133million debt

Creditors are many and varied with no potential buyer yet to step forward and express interest in the yard at current valuations. Is Perini Navi worth saving?

Business

Related news

Mutual benefit

4 years ago

Thailand lifts travel restrictions for yachts

4 years ago

Palumbo Group to support supply chain

4 years ago

Unprecedented number of new buyers

4 years ago

Reflections on MYS 2021

4 years ago

Perini Navi in €133million debt

4 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek