Charter market in the Balearics reaches plateau

Following a period of significant year-on-year growth, the latest data indicates a stabilisation of charters in the region…

When the Spanish government changed legislation in 2013 to include an exemption to the matriculation tax for EU and non-EU flagged commercial yachts, it opened up the Balearics as a conceivable destination for superyacht charters. Since then, the Spanish Association of Superyachts (AEGY) has tracked the number of yachts obtaining charter licences annually in the Balearics. Compiled by Anne Sterringa, senior charter broker at Camper and Nicholsons Spain and a member of the AEGY Board, the data has shown significant growth in the Balearic charter sector over a period of just four years.

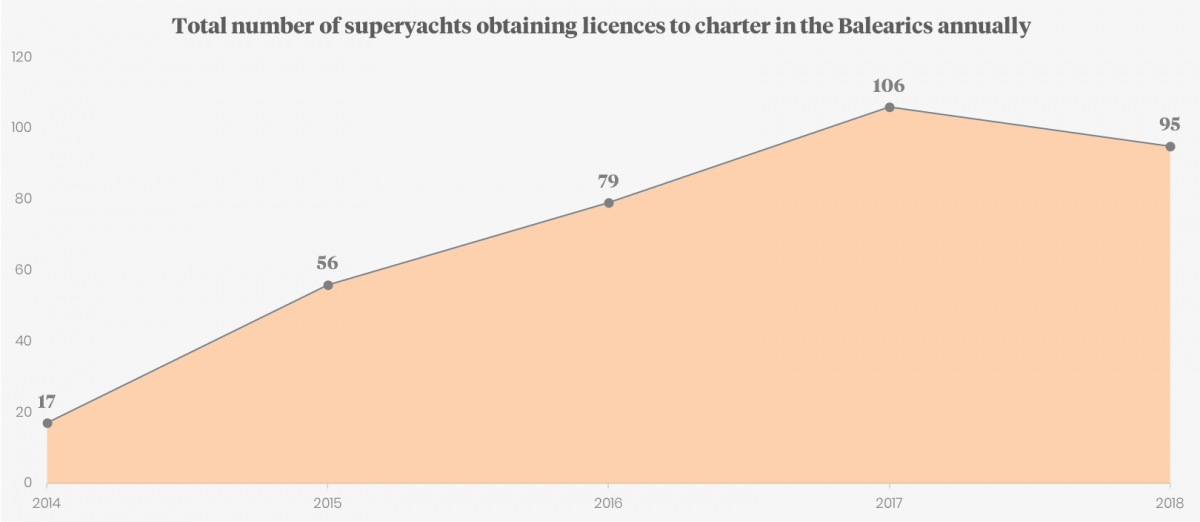

As shown in the graph below, the growth was initially slow: the number of superyachts that obtained charter licences in 2014 was only 17, which reflected a low market confidence in the region. In 2015, numbers more than tripled and continued to rise significantly in the following years, exemplifying the dramatic impact that the reforms to the matriculation tax had made. The most recent data collated from 2018, however, shows a slight drop in the number of yachts with charter licences, with a total number of 95 superyachts compared to 106 the previous year.

This slight decrease in numbers is not to be perceived as a negative for the region, but more as a natural levelling out of the market. Discussing the latest data with SuperyachtNews, Sterringa reasons that this is to be expected and that the number of superyachts available for charter in the Balearics annually is likely to plateau around 100.

“If we consider that the total number of superyachts available for charter in the western Mediterranean is around 700, and given that there are six key destinations within that area, then a little over 100 yachts actually chartering in the Balearics would be a normal and respectable part of the fleet,” she explains. “It is very possible that 100 yachts annually are about the Balearics’ fair share of the market and numbers will stabilise around this figure.”

Sterringa also points out that, while the numbers relate to those yachts that have obtained a licence to charter, and therefore an interest in coming to the region, it does not necessarily indicate that the yachts actually chartered in the Balearics that year. She notes that while the data shows that there were more yachts with licences in 2017, about 30 per cent of these yachts didn’t actually charter in the Balearics, compared to 2018 when about 20 per cent of those with licences didn’t charter in the Balearics. Given this context, the numbers of yachts actually chartering the Balearics between 2017 and 2018 are relatively similar.

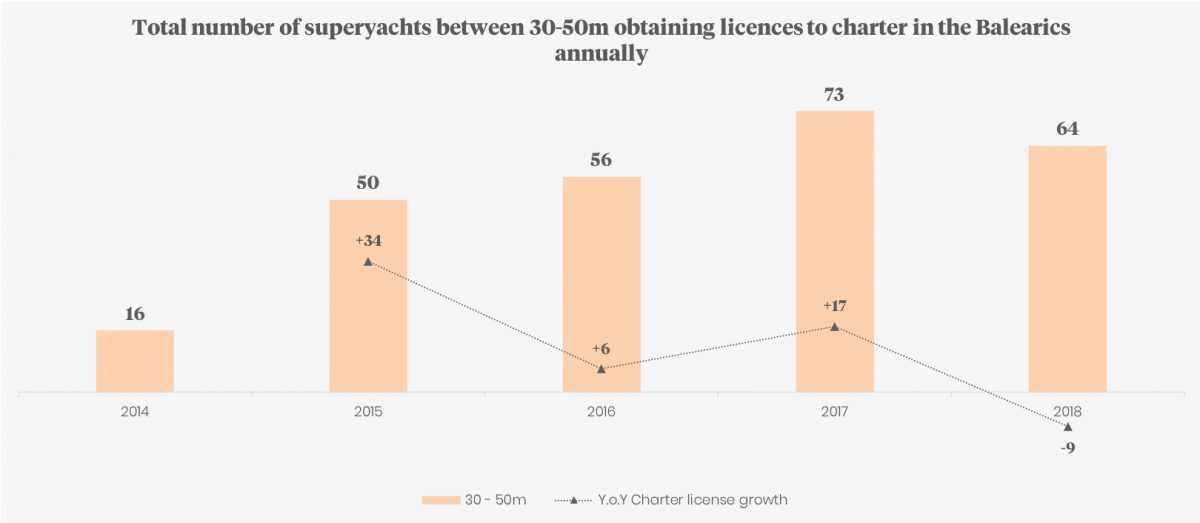

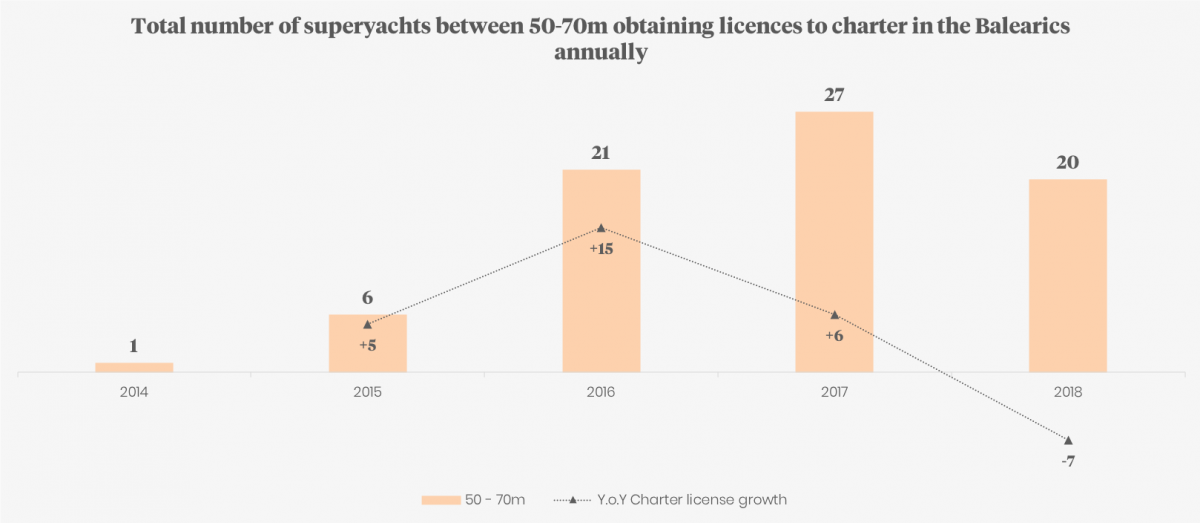

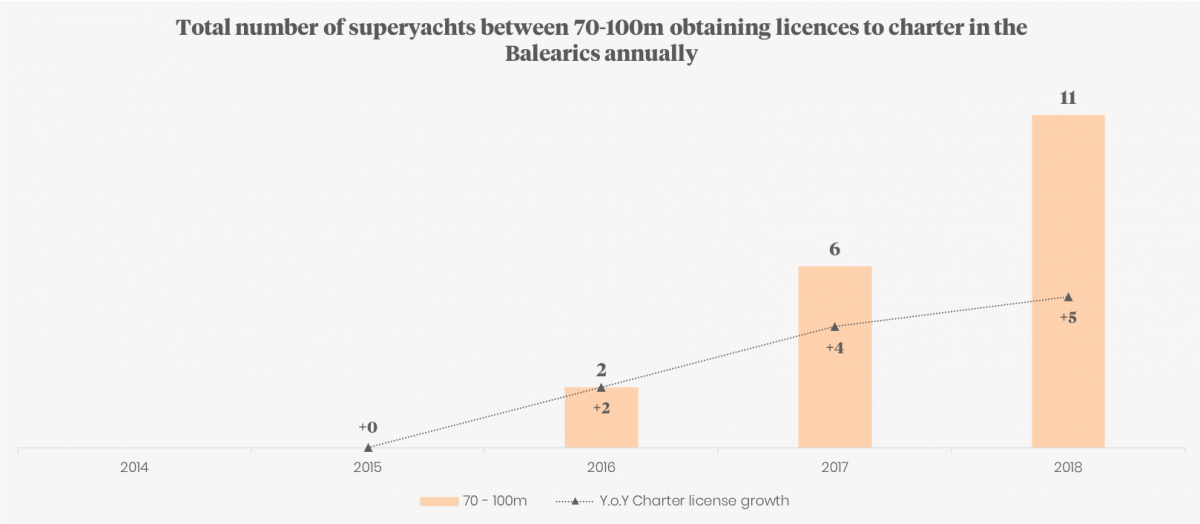

What breaking down the data into separate size categories shows is that there has been a ripple effect in terms of the size of yacht interested in chartering in the Balearics. While smaller yachts between 30 to 50m were quick to obtain licences following the 2013 change in legislation, mid-sized yachts between 50 to 70m didn’t follow the trend until a year later, and larger yachts between 70 to 100m followed a year after that. With the most initial year-on-year growth in the 30 to 50m segment in 2015, followed by the 50 to 70m segment in 2016, the data indicated that the trend would continue for larger yachts, and this is exactly what has happened in 2018.

The year-on-year growth for 2018 has decreased in both smaller segments, but has been substantial for the 70 to 100m segment, with five more yachts in this size category having registered for charter in the Balearics. This a positive indicator of the health of the charter market as often larger yachts will be the most hesitant to visit a destination if concerns with taxation or legislation still exist.

As well as natural plateaus, migratory trends are often key factors that impact the numbers of yachts chartering in a certain region. “I think the novelty of the Balearics as a destination has worn off slightly,” reflects Sterringa. “There was a lot of hype around the region when the matriculation tax exemption was first introduced and the Balearic Islands were very on trend. But every year there is a different trending destination: a couple of years ago it was Ibiza, last year it was southern Italy and this year it seems to be Mykonos in Greece.”

Sterringa adds that one of the main barrier’s to further growth is Spain’s full VAT rate of 21 per cent on charters, compared to the reduced rate that charters in France and Italy can qualify for. “From a client’s point of view, paying more VAT is money down the drain and can be very off-putting when comparing charter options in nearby countries,” she concludes. The complete elimination of the matriculation tax would also open the region up to more yachts. This is currently being lobbied in Brussels by national associations – please click here for the SuperyachtNews coverage.

Want more information on the latest superyacht migratory trends? Look out for the publication of The Superyacht Migration Report later this year. Click here to subscribe.

Data in this article has been provided by AEGY and illustrations have been created by Superyacht Intelligence.

Profile links

CAMPER & NICHOLSONS INTERNATIONAL

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek