CNI:INCandid Conversation / Wealth and Investment

Martin Redmayne chairs CNI's webinar to discuss the world of wealth and investment post-COIVD-19…

When the dust settles and the world emerges from the chaos of the COVID-19 pandemic, there will be winners and there will be losers. In the fifth of the CNI:INCandid Conversation series, hosted by The Superyacht Group’s Martin Redmayne, Thomas Veraguth of UBS Switzerland and Camper & Nicholsons International’s Jenny Skoog discussed market recovery, wealth retention and the profound effect of national debt on nations’ ability to attract UHNWI clients.

“If you look closely at what [UHNWI] clients have done throughout this period, a lot of private clients have been very active in this environment. This is very interesting to see that private clients have been very active, while institutional clients have been waiting and not changing their positions so quickly,” started Veraguth, strategist at UBS Switzerland AG. “Therefore, we have a lot of liquidity in the market and private clients have been very active buying at market lows and making nice returns.”

That this period of crisis and uncertainty has yielded positive results for large parts of the UHNW population can only bode well for the superyacht industry. When the severity of the COVID-19 pandemic was realised, it caused a sudden and significant fall in brokerage enquiries, and simultaneously, an almost complete crash in the charter market. However, unlike the post-global financial crisis era, this collapse was less to do with a sudden fall in fortunes and an inability to pay creditors, and far more to do with the logistical nightmare and impossibility that international travel became. Indeed, few people are brave enough to buy a superyacht without seeing it, and no one is happy to pay for a holiday that they can’t go on.

“When I first joined the superyacht industry five years ago, the first thing I looked at was what happened before the GFC and then what happened after. So far as we can see from the statistics, the market was strong prior to the GFC, but it was also not very regulated; it was easier to get financing, it was a real boom period that had very easy conditions,” explained Skoog, group chief financial officer at Camper & Nicholsons International. “However, after we saw the introduction of far greater regulation and a far higher demand in terms of compliance, including AML and the like… there was a decrease in the activity of our clients.”

While some bemoan the increase in regulation and compliance as a limiting factor for generating new superyacht business, it isperhaps, precisely this limiting factor that has meant owners and clients have returned to both the brokerage and charter markets so swiftly as lockdown measures begin to be reduced.

“Today we are definitely seeing some interest - people have been waiting to see when the border would open and so on - the same goes for sales and we are really starting to see activity pick up,” continued Skoog. “During the crisis we, of course, had a lot of cancellations and a lot of sales that were put on hold due to travel restrictions and so on. But, our clients, like more people right now, are ready for a European summer; they want to get out and enjoy their lives.

That clients are returning to the sales and charter markets is fantastic news. Naturally, due to the parts of the season that have already been missed and some sales that may never get back off the ground, 2020 will remain a poor year for the superyacht industry, as indeed it will for many industries around the globe. Nevertheless, it seems as though the three key markets, namely new build, brokerage and charter, will bounce back in due course. However, the pinch might be felt more acutely by certain stalwart superyacht regions that may struggle to compete with their upstart neighbours.

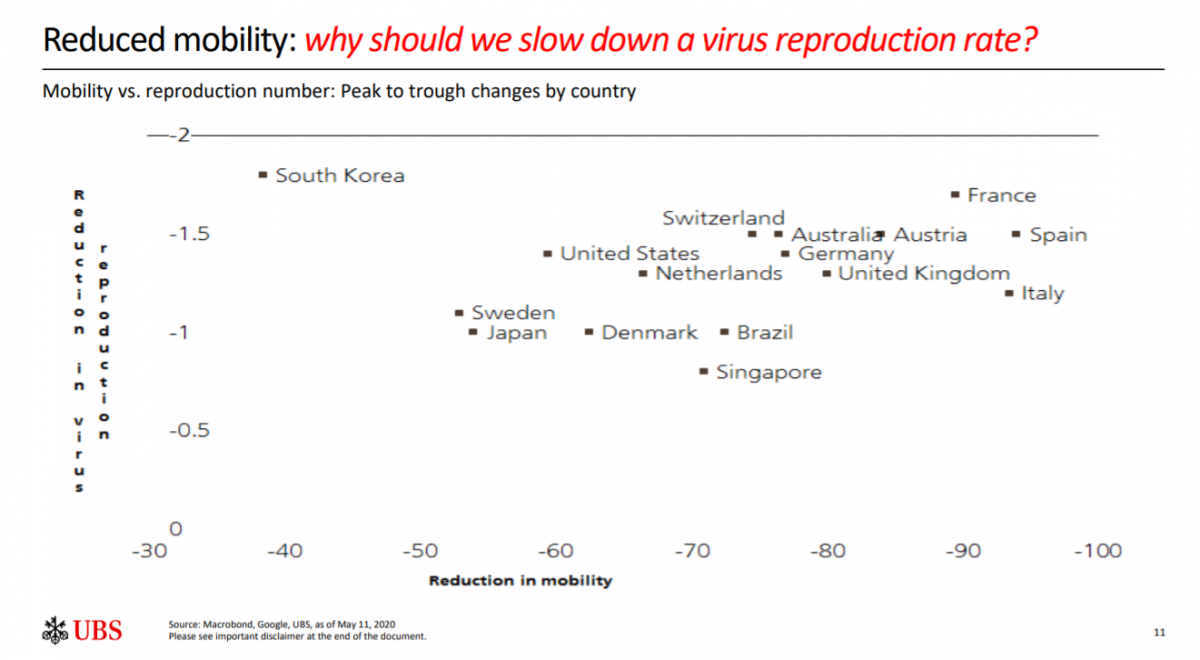

“We are still seeing a high fear level. What I want to bring to your attention, however, is that throughout lockdown there has been no correlation between number of deaths per day…versus how strict lockdowns have been,” continued Veraguth. “I would argue that these are the facts that must be considered when understanding what has been done to various economies. For many lockdowns, the peak of the virus came before the lockdown itself, which suggests that, on average, the lockdowns came too late, which further suggests that the lockdowns have been ineffective in terms of controlling the peak of the virus. This is another way of highlighting the relationship between the virus and mobility restrictions.”

According to Veraguth, countries like France, Italy, Spain and the UK implemented their lockdowns at such a time that it failed to control the peak of the virus, negating the benefit of the lockdown in the first place. Furthermore, other countries that have had less strict lockdown measures have not in fact been affected more profoundly by the virus. What has happened, however, is that certain major countries, like the aforementioned, have found themselves in even deeper positions of debt on top of the fact they already had poor debt positions.

“The important thing to know is that some countries are coming out of the crisis and recovering faster than others and this is going to have a material impact on how people invest in the coming quarters,” said Veraguth. “The ones that open quickly, or that never locked down, will be the winners. Why? Because we haven’t seen any link between the virus and lockdown, so the conclusion should be that in order to win, you should open up businesses and not fear a second wave. Those that open up late will lose their market share, as well as falling into a deeper economic and political crisis.”

For those countries that do not open up in a timely manner, Veraguth warned that their deepening debt positions will force them to increase taxes and reduce their spending. For EU nations especially, this will become a necessity. If this proves to be the case, superyachting nations like Italy, France and Spain may struggle to compete with countries like Croatia and Montenegro. Indeed, we are already seeing movement on the side of Croatia and Montenegro to welcome superyachts to the regions with minimal restrictions.

In the long run, the COVID-19 pandemic will be to the benefit of new luxury destinations that have managed to come out of lockdown far quicker than a number of traditionalluxury destinations that have failed to do so. Countries that have managed to restrict the damage to their economies and avoid damagingly deep debt positions will have far more flexibility when it comes to introducing taxation policies and measures that are attractive to UHNWIs.

Profile links

CAMPER & NICHOLSONS INTERNATIONAL

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

P&O Marinas agrees strategic partnership with Pindar Yacht Management

The strategic partnership is intended to turn Mina Rashid in a regional maritime hub

Business

Moonen Yachts announces new management team

The Dutch superyacht builder has announced changes to its management team with immediate effect

Business

YPI's Peter Thompson discusses the brokerage market

Logistics remain a major stumbling block for the brokerage community regardless of increasing enquiries

Owner

CNI:INCandid Conversation / Charter

A panel of industry experts discuss delivering the 2020 summer charter season following the COVID-19 crisis

Business

Shipyard status update: Lauderdale Marine Center

Doug West, president of LMC, discusses the facility's operations, performance, outlook and ongoing developments

Business

Intesa Sanpaolo and Sanlorenzo sign €50 million agreement

Financial support for the working capital of suppliers by means of advances on trade receivables

Business

Related news

Moonen Yachts announces new management team

5 years ago

CNI:INCandid Conversation / Charter

5 years ago

Shipyard status update: Lauderdale Marine Center

5 years ago

Interaction and control

5 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek