CSE publishes economy-wide ESG performance study

The CSE has just released its annual ESG research. Here, Professor Nikos Avlonas discusses the findings and the superyacht industry’s status…

The Center for Sustainability and Excellence (CSE) has released its annual research on ESG, unveiling insights and trends from information gathered from over 200 companies listed in the FT 500 across the United States, Canada, and Europe. The study shows that almost all of these companies (83 per cent) have medium to high ESG scores. Sustainablilty Editor Megan Hickling speaks with Professor Nikos Avlonas, President of CSE since its founding over 20 years ago, to explore this study and discuss the superyacht industry’s position and future progression.

CSE is a company specialising in consulting with and educating companies to maximise their social, economic and environmental impact. The study provides further details on companies’ actions within the ESG field and the benefits they’re experiencing as a result. These ESG scores were determined through rating systems from organisations such as CDP, Sustainalytics and S&P. More than 80 per cent of the companies included in the study have ESG reports adhering to international standards frameworks created by the Global Reporting Initiative, Sustainability Accounting Standards Board, and the Taskforce on Climate-related Financial Disclosures. This adherence contributes to their medium to high ESG scores.

Professor Nikos Avlonas, President of CSE

Professor Nikos Avlonas, President of CSE

Several benefits were identified during the study associated with those with higher ESG scores. Avlonas explained that well-defined ESG strategies and objectives encompass ambitious goals at all business levels, including environmental, social and governance issues, and encompass operations and the supply chain. Avlonas adds that an ESG strategy should be a “holistic strategy that supports and relates to the business strategy”. The study found that having this kind of strategy assists in better navigating ESG-related risks, thereby mitigating operational costs and enhancing market resilience. Strong ESG performance also deepens stakeholder relationships, resulting in improved customer loyalty, better employee retention and an enhanced overall reputation.

Avlonas emphasises, “These findings underscore the crucial role of ESG practices in fostering sustainable, resilient, and financially viable businesses. CSE’s research not only serves as a barometer for industry best practices but also provides actionable insights for companies looking to enhance their ESG frameworks.”

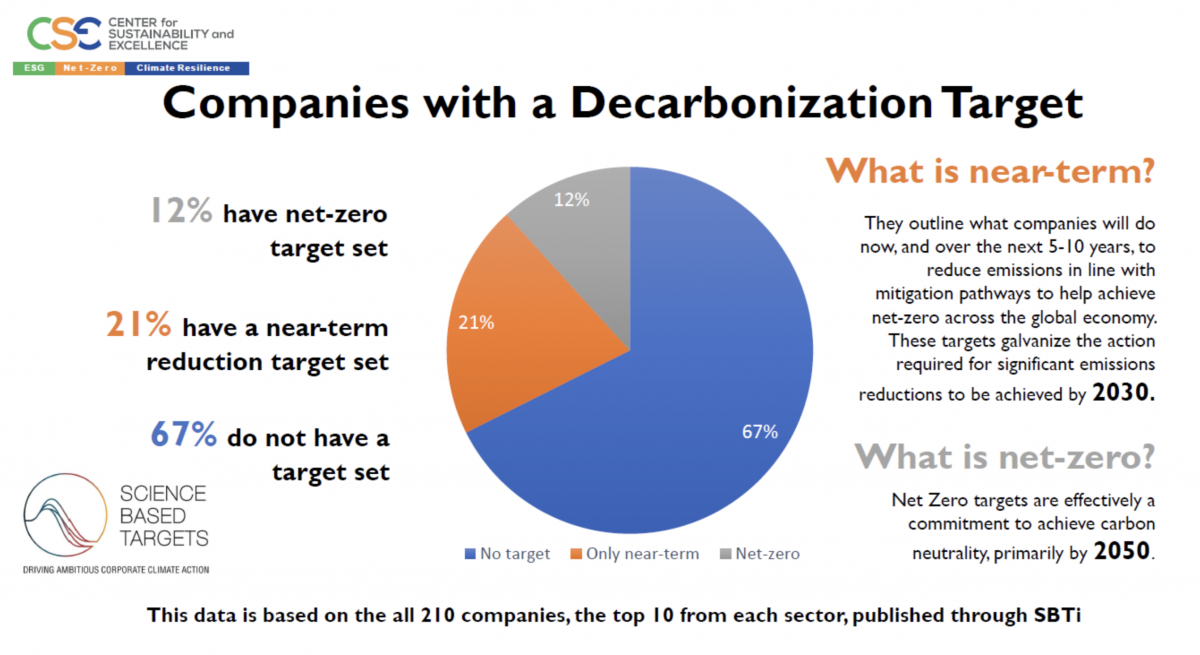

Another key aspect of these reports is the decarbonisation targets set within them. Some 20 per cent of the 200 companies included in the study have emissions reduction targets for 2030. This seemingly low uptake of near-term goals could be due to the fear of not being capable of reaching such targets within that timescale. While many are waking up to the need for better ESG within their company, it can be a challenging area for many to accelerate their efforts and performance due to the time-consuming learning, research and investigation often needed to inform the actions to make the much-needed improvements. Avlonas suggests that this challenge contributes to the relatively good adoption rate of 20 per cent, though he highlights an issue of transparency among these plans. While many have outlined higher-level plans to achieve these goals, detailed plans of exactly how this will be achieved are rarely provided.

While the changing nature of the field and hence changing assessment methodology means it’s almost impossible to directly compare the results of this annual study across the years, Avlonas noted an overall improving trend. Despite this, and the other benefits, one particular gap found by the study is that not many of these companies adopt Science-Based Targets Initiative (SBTi) approved goals. CSE proposes that this lack of uptake is probably due to “apprehensions about cost and complexity”. However, a higher percentage of European companies have adopted these types of goals compared to Northern American companies, reflecting increased awareness, legislation, and performance in ESG in Europe.

Avlonas and CSE have been involved with the Water Revolution Foundation for the past five years, providing training to many in the superyacht industry on sustainability in business. This experience, combined with knowledge from other industry performances, allows Avlonas to make some comparisons. He estimates that the superyacht industry is about seven to 10 years behind any industry in Europe. This lag is probably due to the relatively small size of the industry and conflicts that can arise between owners’ desires and sustainability goals.

Compared to the shipping industry, which Avlonas has been involved with for more than 10 years, he discusses how they’ve only acted to make environmental impact improvements because of legislation pushed onto them. He explains: “The shipping industry, for example, if you took a look five years ago, it was much further behind. Today it’s extremely close or even relevant to any other industries in the field, which means that legislation and pressure work and provide results.” He further explains that while the shipping industry may be complaining about these new regulations, they are nonetheless complying and improving.

Avlonas is one of many who believe similar legislation is needed for the superyacht industry to make similar improvements. This is likely to be demonstrated by the results of the soon-to-be-implemented CSRD and the Green Claims Directive. Avlonas sees these as key drivers for the future, stating, “It's going to have a high impact in the next two to three years.” He explains that these directives are demanding and will probably significantly change the superyacht industry, at least for companies operating in Europe. CSRD alone will affect 50,000 companies across the EU and involves 120 different criteria for the reports.

While the superyacht industry is just beginning to see a new wave of companies publicly sharing their sustainability efforts, exemplified most recently with Burgess publishing their impact report early this year, and with the upcoming results of legislation such as CSRD and the Green Claims Initiative, we can expect many more businesses within the superyacht industry to follow suit. As more companies strive to improve their ESG credentials and attain associated benefits to their business, highlighted by this survey, the industry's sustainability efforts are likely to accelerate.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Corporate sustainability jargon busting

As more requirements come into effect that will directly affect the corporate world, we explain pertinent sustainability-focused terms

Technology

Don’t be left high and dry

Nigel Marrison, founder of Blue ESG, says how we tackle global-emissions goals will determine the very future of superyachts

Crew

TISG outlines ESG commitments

The Italian Sea Group details its diverse ESG strategy to reduce current CO2 emissions as well as offset those from 2022

Business

UK new build sector remains optimistic despite economic pressure

Stephen Hills, Commercial Director at Pendennis and Chairman of Superyacht UK, looks at how 2022 shaped the UK shipbuilding industry

Business

Related news

Corporate sustainability jargon busting

12 months ago

Don’t be left high and dry

1 year ago

TISG outlines ESG commitments

1 year ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek