Fasten your seatbelts

Jonathan Beckett, CEO of Burgess, considers the potential for 2022 across the market's three core buyer markets…

If one considers the (quite understandable) pessimism that was rife in 2020, the market sentiment at the top end of 2022 could not be more different off the back of a year that was record-breaking across a number of sectors. We speak with Jonathan Becket, CEO of Burgess, to understand what he expects from the three core buyer sectors over the course of the year ahead.

“I have never experienced a year quite like the one we have just seen in my 41 years at Burgess,” starts Jonathan Beckett, CEO of Burgess. “In order to determine what will happen in 2022 with absolute certainty, as ever, I would need a crystal ball. However, the market is in a very good place and there is a lot of money around at the moment. From the Burgess perspective, we are predicting another very strong year. That being said, the difference between a strong year and an outstanding year might be the matter of two very large deals and such things can be incredibly difficult to predict.”

By this point, various brokerage reports have highlighted the record-breaking year that 2021 proved to be. Indeed, Burgess experienced its own record-breaking year with 45 superyacht sales worth over €2billion, which equates to a 27 per cent increase on the previous best year. According to a recent Burgess announcement, over 50 per cent of these sales were over 50m.

“Our 2021 figures were so strong thanks to three large sales at the tail end of the year that we closed, as well as closing a couple of big new construction projects,” continues Beckett. “However, it is perfectly feasible that, following such a strong year for the market, a lack of supply may become a factor in 2022, which in turn couple impact pricing. However, as it stands prices are sensible. There is no more COVID pricing, you can’t go out and find cheap deals for excellent superyachts but, equally, I don’t think prices are overinflated by the demand at the moment. Prices seem fair, which is terrific.”

As well as boasting a record year for brokerage, Burgess’ new build construction department also had enjoyed a record-breaking year with revenues having grown 39 per cent when compared with 2020. However, like with the second-hand market, various concerns relating to availability and capacity have been voiced by industry commentators.

“Regardless of how big the order book has become, I believe that buyers are still going to be ordering superyachts this year,” says Beckett. “Obviously, the delivery dates have been pushed out, but there is still confidence amongst buyers, especially the younger ones. Buyers are concerned that the longer they wait, the longer they will be waiting if the order book continues to grow, which we fully expect it to in 2022. What we have certainly noticed over the last year is that COVID has significantly shifted the trigger point for superyacht sales. Buyers are getting younger.”

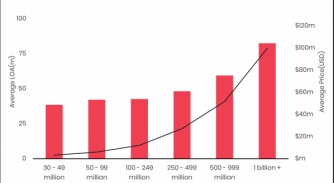

According to Forbes billionaire’s list, the number of global billionaires grew from 2,095 in 2020 to 2,755 at the close of 2021, which may go some way towards explaining the booming activity across new build and brokerage when considered in conjunction with various theories for market growth that are currently doing the rounds, from safe havens, to superyacht workspaces, to simply getting off the fence in light of ones own mortality.

While the new build and brokerage markets typically grab the headlines, it is almost ubiquitously accepted that the charter market remains the best breeding ground for buyers. It should come as some comfort for the market then that 2021 also proved to be a success from a chartering perspective. Unlike new build and brokerage, however, charter did not experience a record year, with that record being held by 2019. To some, this may seem like bad news, but charters pre-COVID health somewhat suggests that the growth across new build and brokerage was already on its way and that the purple patch that is being experienced may be more sustainable than some have given it credit for.

“The charter market at the conclusion of 2021 was our second-best year ever, which we had not predicted at the beginning of 2021,” explains Beckett. “Our best year was 2019, but what we achieved in 2021 was excellent. Last year, to a certain extent, we were catering for the best but also planning for the worst. This year, I would say that we have every chance of breaking our 2019 record.”

There are of course long-term challenges on the horizon, especially where the market is concerned with environmental, social and governmental targets. However, in the short term, Beckett believes that one of the most pressing challenges is attracting new buyers into the market and correctly identifying where to target resources in order to effectively educate and engage buyers.

“Fasten your seatbelts - we’re in for another exciting 12 months. There will be some bumps in the road, but if we work hard and concentrate, we all stand a great chance of success.”

Seldom has there been so much optimism in the air for the superyacht market in recent history. Regardless of how unpredictable the pandemic and its various by-products have been, at this juncture, supported by various market commentators, it is hard to be anything but positive.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Introducing NFTs to the superyacht community

Andrew Grant Super, managing director of Berkeley-Rand, is paving the way for superyachts and NFTs

Owner

Editors’ Roundtable

In a departure from standard practice, it was our editors who were under the microscope this time

Business

What can I get for my money?

We explore what is available to buyers on today’s brokerage market

Owner

The Italian Sea Group acquires Perini Navi

The Italian Sea Group wins the sale of Perini Navi for €80million at the third time of asking

Business

Related news

Introducing NFTs to the superyacht community

3 years ago

Editors’ Roundtable

3 years ago

What can I get for my money?

3 years ago

A year in review

3 years ago

The Italian Sea Group acquires Perini Navi

3 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek