Let's get down to business

With MYS just around the corner, we compare data from the 2019 and 2021 shows…

It is fair to say that the preparations for Monaco Yacht Show (MYS) 2021 have been anything but normal. Thanks in large to the pandemic and to a lesser extent the new MYS format, even the most seasoned MYS veterans are walking into an entirely new experience. Much of the chatter over the last 12 months has been about the success of the brokerage and new build markets without the impact and cost of the boat shows. We explore the data to highlight and differences that may exist between the 2019 and 2021 offering.

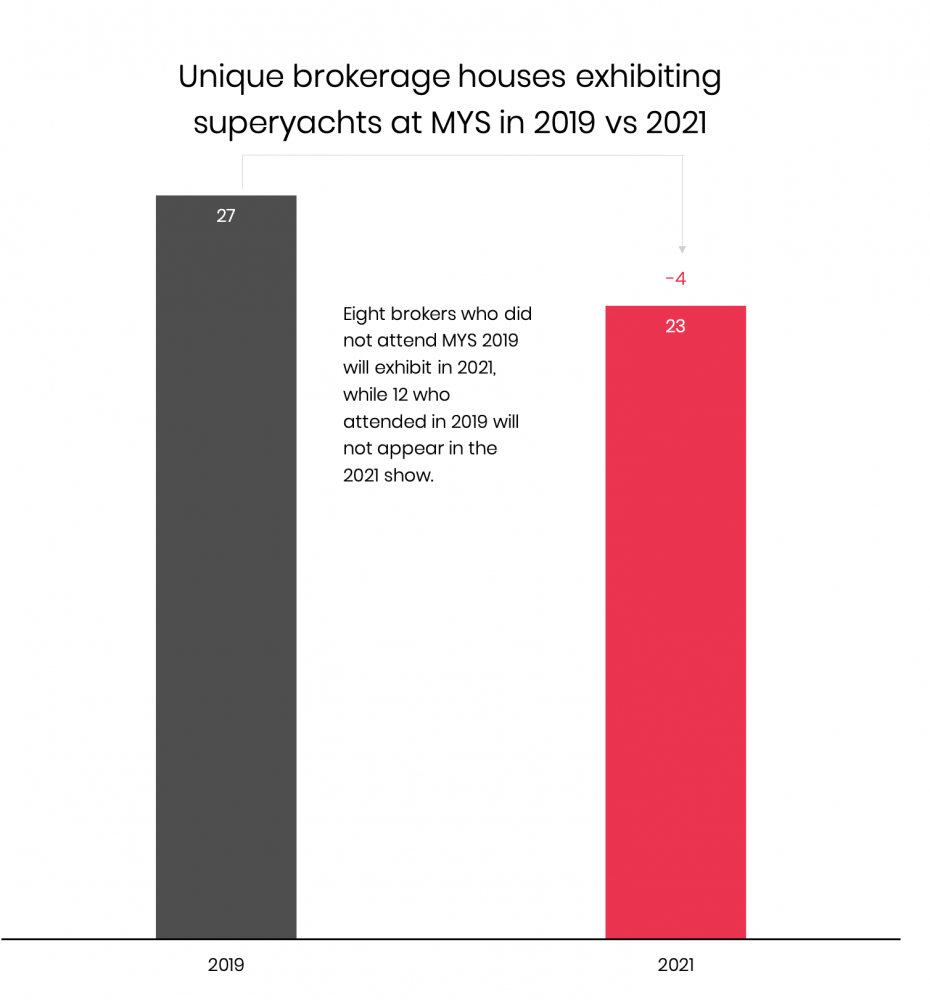

According to data analysed by The Superyacht Agency, there are four fewer brokerage houses exhibiting superyachts in 2021 (23) than there was in 2019 (27), representing a relatively minor drop off in engagement. Eight brokerage houses that did not showcase any vessels at MYS in 2019 will exhibit in 2021, however, 12 houses that did attend with superyachts in 2019 are no longer doing so. In total, the number of superyachts showcased by brokerage houses has fallen from 71 in 2019 to 45 in 2021. Additionally, the number of showcased superyachts that are for sale has decreased by 60.4 per cent.

That the decrease in vessels for sale is greater in percentage terms than the decrease in superyachts exhibited is perhaps indicative of how successful the brokerage market has been throughout 2020 and 2021. With so many sales having been conducted over the last 18 months, it stands to reason that there would be fewer top-quality vessels available for sale at MYS. Furthermore, with travel restrictions still in place, limitations set, and the desire on the part of some superyacht owners to extend their summer cruising seasons, is it any wonder that the number of superyachts on show has decreased?

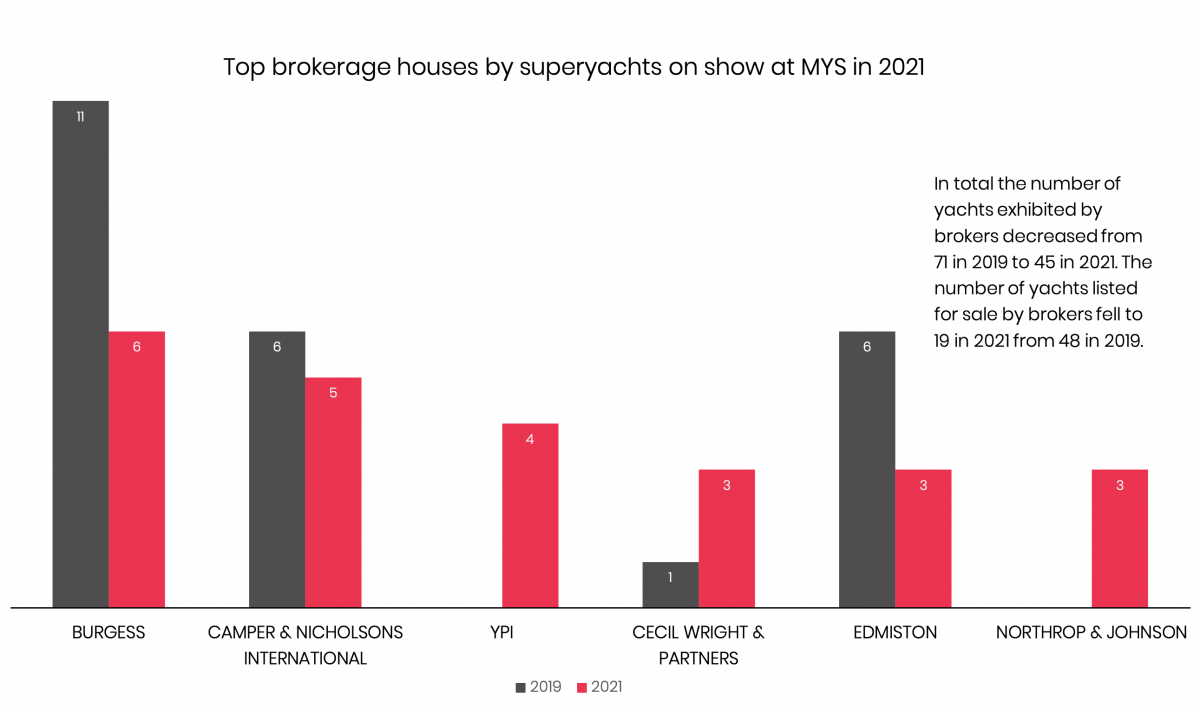

The brokerage houses with the largest superyacht presences at MYS are Burgess (six yachts), Camper & Nicholsons International (five) and YPI (four). Interestingly, both YPI and Northrop & Johnson are presenting superyachts at the 2021 event having not had any vessels present at the 2019 event.

The brokerage houses with the largest superyacht presences at MYS are Burgess (six yachts), Camper & Nicholsons International (five) and YPI (four). Interestingly, both YPI and Northrop & Johnson are presenting superyachts at the 2021 event having not had any vessels present at the 2019 event.

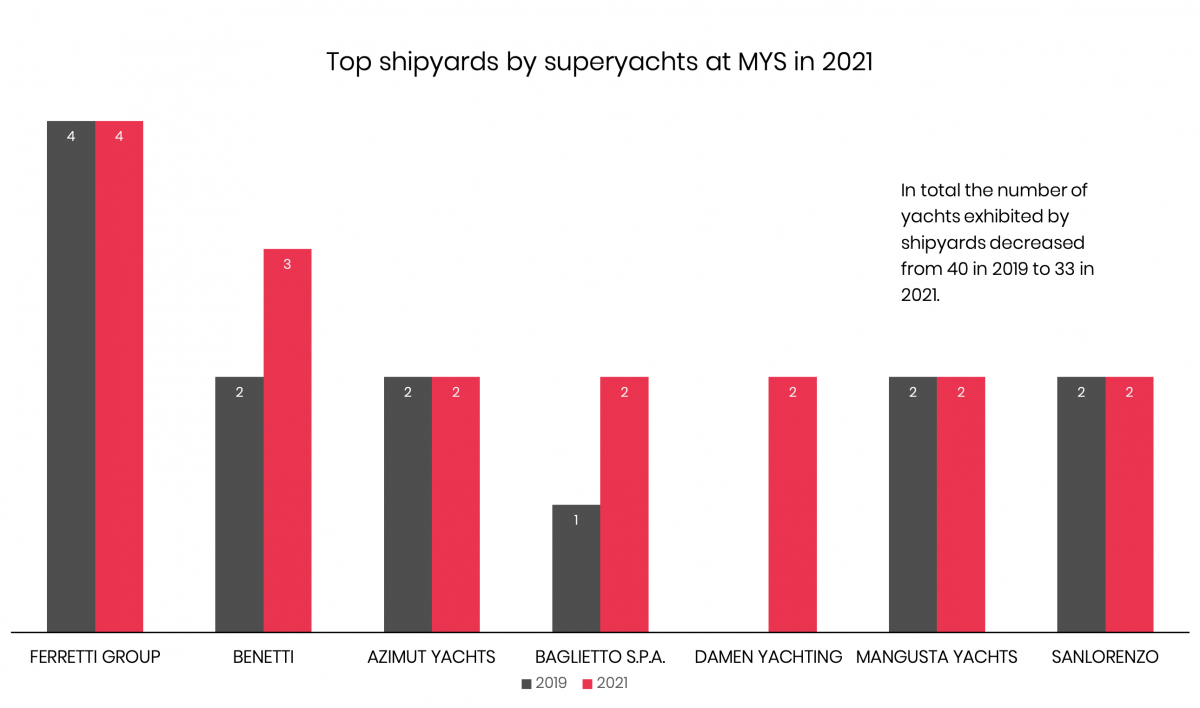

It is a similar story with the shipyards, with only five less shipyards bringing projects to the 2021 event when compared to 2019. Of those shipyards that exhibited in 2019, 15 are not showcasing any projects in 2021, while 10 shipyards that did not exhibit a superyacht at MYS 2019 are doing so in 2021, with a total of 33 superyachts being shown, representing a decrease of seven yachts in comparison with 2019. The above figure showcases those shipyards that will have the largest on-water presence at MYS 2021.

It is a similar story with the shipyards, with only five less shipyards bringing projects to the 2021 event when compared to 2019. Of those shipyards that exhibited in 2019, 15 are not showcasing any projects in 2021, while 10 shipyards that did not exhibit a superyacht at MYS 2019 are doing so in 2021, with a total of 33 superyachts being shown, representing a decrease of seven yachts in comparison with 2019. The above figure showcases those shipyards that will have the largest on-water presence at MYS 2021.

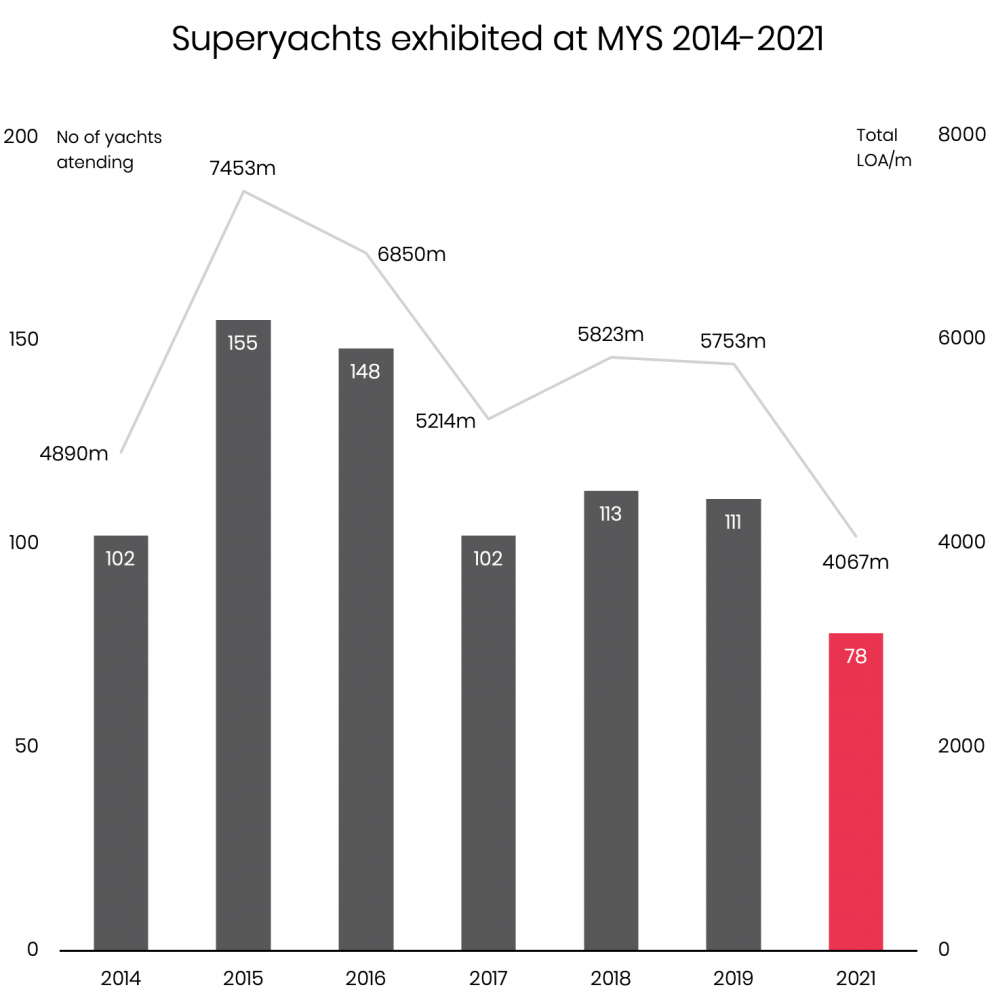

In total there are 78 superyachts at MYS, 33 less than there was at MYS 2019, with the most significant decrease in numbers coming from the brokerage community.

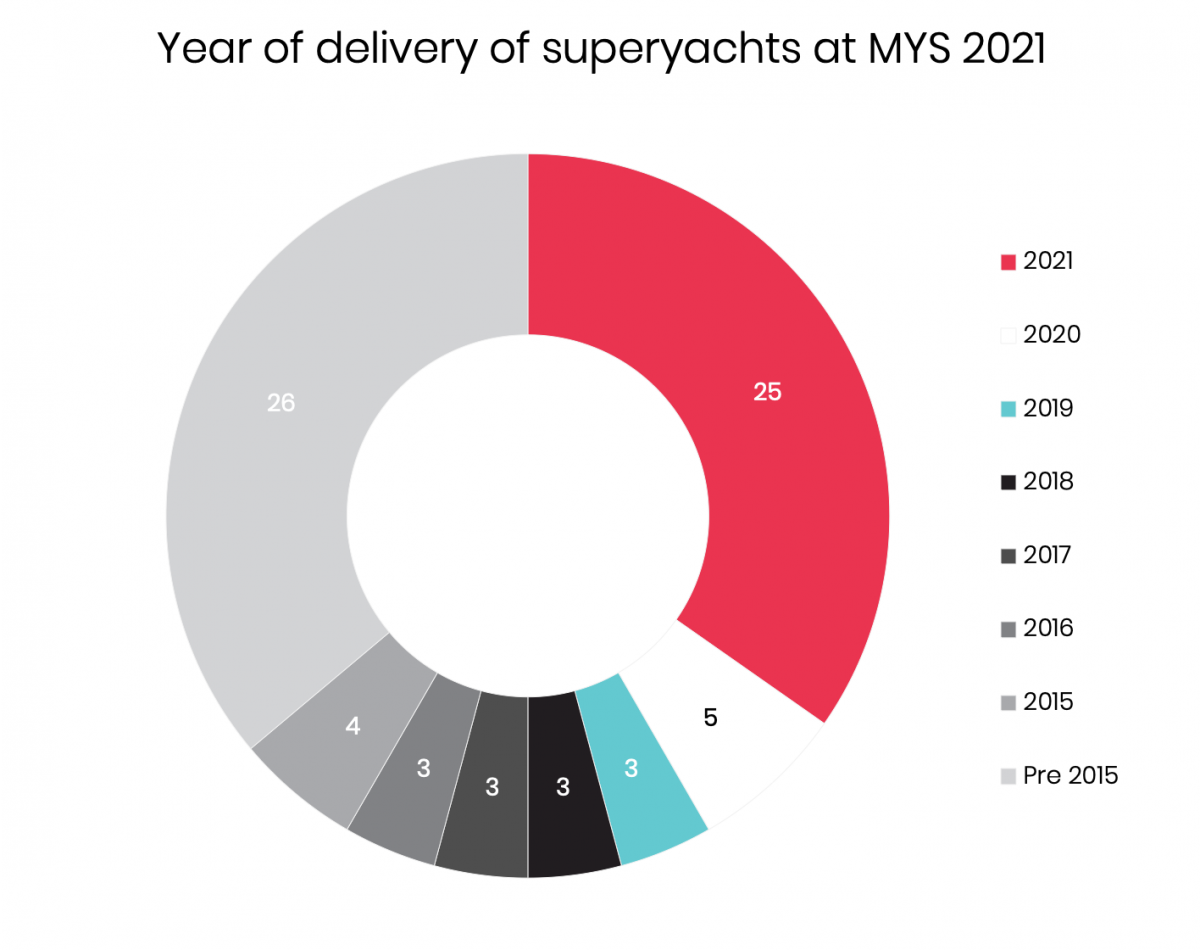

The inventory that is in attendance, however, is dominated by new and nearly new projects with 46 per cent of all the vessels in attendance having been delivered within the last three years.

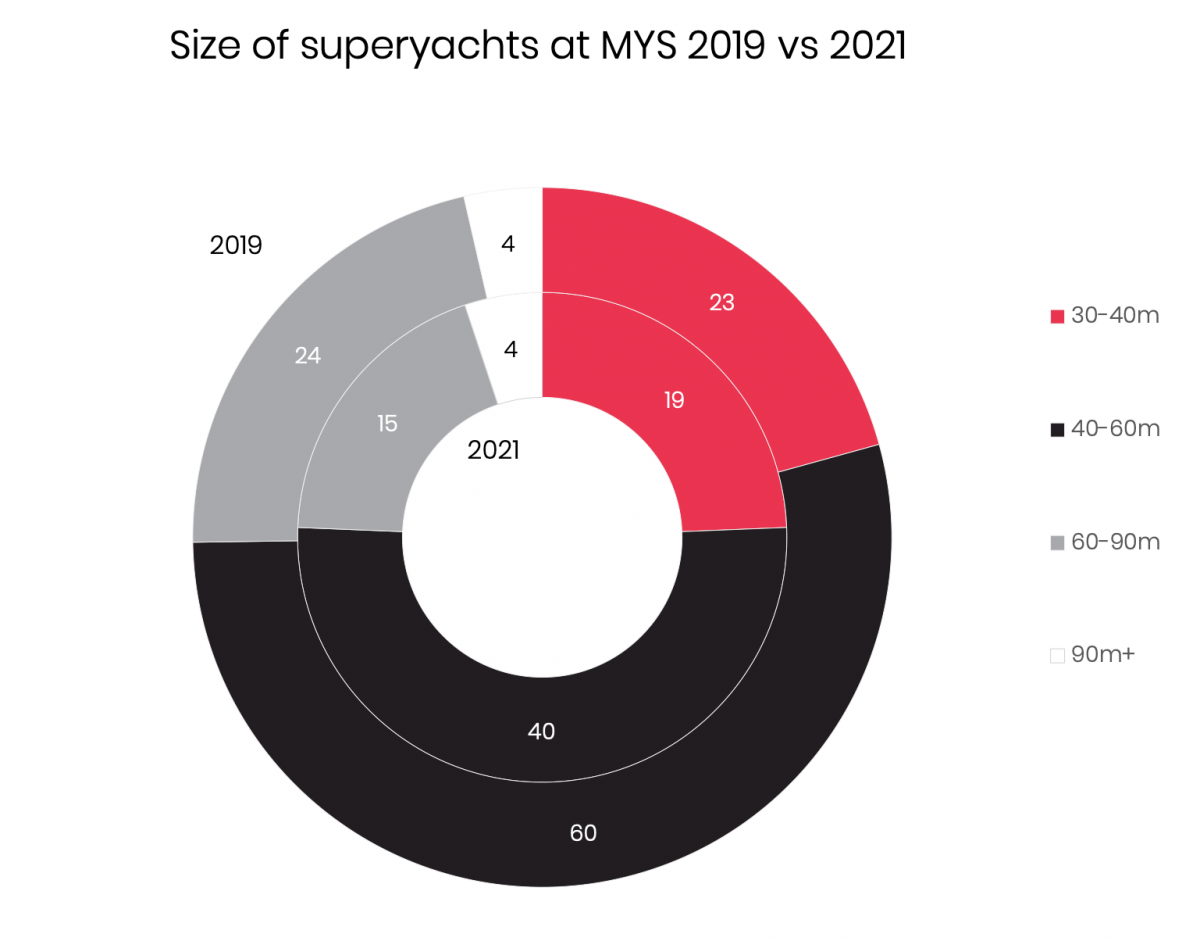

As is MYS’s USP, the vessels on show are dominated by large superyachts with the most prolific sector being between 40-60m. Indeed, there are only four more 30-40m yachts (19) than there are 60-90m projects (15), highlighting that MYS remains the dominant boat show for those buyers that have the financial clout and wherewithal to commission or buy the largest superyacht available. It is, however, within the 60-90m range where the greatest decrease in exhibited superyachts has occurred with a fall of 37.5 per cent since 2019, which is perhaps, once again, a testament to an incredibly buoyant superyacht market.

It would be somewhat naïve to not at least refer to the fact that there have been issues relating to costs raised by the brokerage market. To suggest that the drop in superyacht numbers at MYS 2021 is purely down to a buoyant brokerage market and the unique pandemic environment would be unfair to some of the market’s most crucial stakeholders. However, what is fair to say is that 2021 is a transitional year. With a new format and a revamped layout, 2021 represents the first time that MYS as an enterprise has taken stock of the issues levied by the industry’s stakeholders and implemented changes as a result. Unfortunately, the changes have come during a pandemic and the success of these changes will, as a result, be harder to measure.

However, with the brokerage community highlighting the fact that 2020 and 2021 have been characterised by the appearance of new entrants to the superyacht market, especially where this relates to buyers, let us hope that buyers both new and old still see the value in exploring what remains the large superyacht market's premier shop window.

The data analysed herein was accurate as of 16 September and does not account for late additions to the show.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Myanmar's junta makes grab for hard cash with auction of illicit timber

"To any timber trader or company thinking of participating in this auction...you are buying blood wood."

Business

Good artists copy, great artists steal

We consider how international investment may be the most reinvigorating force on the US new build market

Business

Bottlenecks and quality control

Is the current new build performance sustainable? How might a lack of capacity impact key deliverables?

Business

The Superyacht Forum Live: Superyacht 2030

One Industry, One Mission, One Forum: What should the superyacht industry look like in 2030?

Business

Yachting in Malta: The Pre-Show Update

Alison Vassallo, partner at Fenech & Fenech Advocates, provides an update on the Maltese solutions for superyachts

Business

The Superyacht Owner Report

The latest edition of The Superyacht Report provides insight into how to optimise superyacht ownership, operation and lifecycle management

Owner

Related news

Good artists copy, great artists steal

4 years ago

Bottlenecks and quality control

4 years ago

The Superyacht Forum Live: Superyacht 2030

4 years ago

Yachting in Malta: The Pre-Show Update

4 years ago

The Superyacht Owner Report

4 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek