Seaborn in the USA

With a presidential election imminent, we dissect the American superyacht market to determine the health of the market across the Atlantic…

Image: Forest Johnson

As the old adage goes, ‘If you can’t beat them, join them’. In yachting, however, it might be more fitting to say, ‘If you can’t build one, buy one’. With US shipyards struggling to keep pace with their European counterparts, American ultra-high-net-worth individuals (UHNIs) have shifted their focus to Europe – not to compete but to invest in the best. And without their influence, the landscape of our industry would be unrecognisably different.

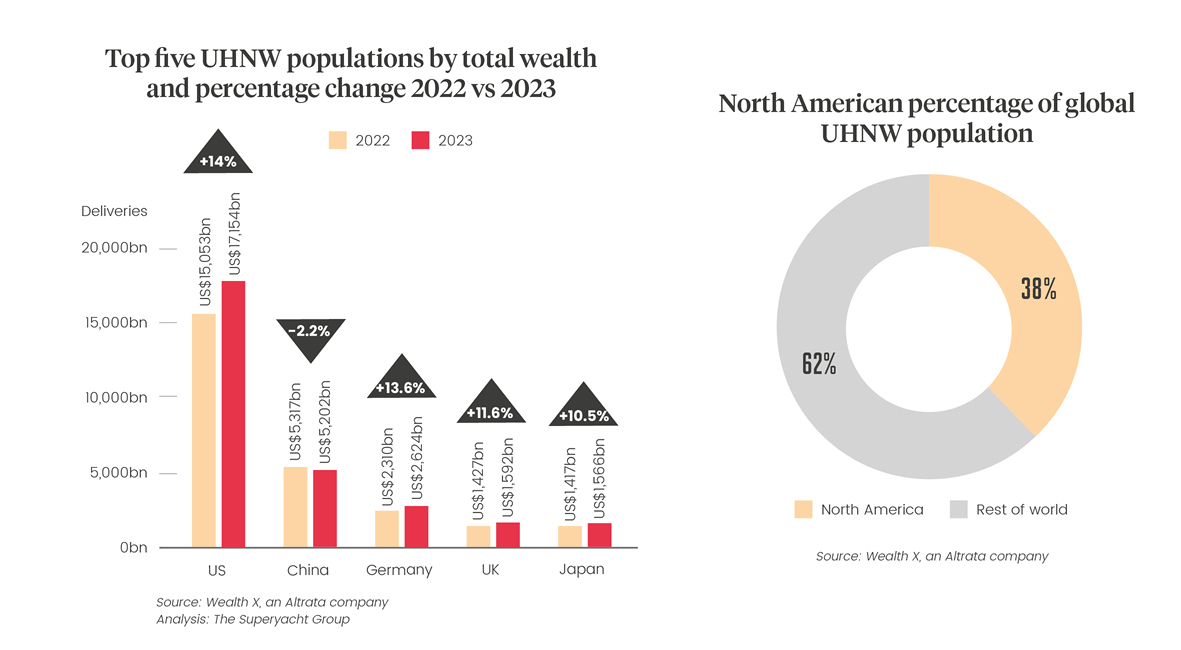

The United States has long been a cornerstone of the global superyacht market, a trend that has only intensified in recent years. North America continues to hold the title of the world’s largest wealth sector, with the UHNW population in the region expanding by 11.9 per cent in 2023 to 161,280, according to Wealth-X World Ultra Wealth Report 2024.

This growth outpaced gains in Europe and Asia, increasing North America’s share of the global ultra-wealthy demographic to 38 per cent. Collective net worth in the region also surged by 11.7 per cent to $18.6 trillion, bolstered by a surprisingly resilient US economy and double-digit equity returns, particularly from the so-called ‘magnificent seven’ mega-cap technology stocks.

Simply put, the American superyacht market has always been the largest and remains a significant source of owners and guests, but the upcoming US election presents a new wave of uncertainty. Furthermore, shifts in global wealth, geopolitical tensions and other potential political changes may reshape the industry in the coming years. So what does the changing economic landscape and the prospect of revitalised leadership mean for the US sector?

In tandem with the highest number of UHNWIs, the US leads in ownership too, with 23.6 per cent of the world’s superyacht owners residing in America as of 2023.

Within this context, Miami has emerged as a prominent financial hub – it’s not all Hawaiian shirts and Tom Selleckesque moustaches, but a place where deals are done. The city now ranks 24th on the Global Financial Centres Index and seventh among North American cities, and its rise as a financial centre has been driven by an influx of hedge funds, private-equity firms and international banks, drawn by Florida’s favourable economic environment compared to traditional financial centres such as New York and California.

“During Covid, there was a noticeable migration of businesses from other states to Florida, driven by a combination of factors,” explains Erin Ackor, partner at Miami-based law firm Moore & Co and president of the International Superyacht Society. “One significant reason, in my view, is political. Florida is run by a Republican governor, which led to policies that were quite different from those in states governed by Democrats.

“For instance, New York took a very strict approach to lockdowns, which led many people to reach a point where they felt enough was enough. In contrast, Florida’s approach was much less restrictive. Businesses and individuals were attracted to Florida because children were back in school within six months, and people were allowed to be outside, unlike in some states where even outdoor activities were heavily restricted.”

There’s also a sizeable tax difference between states. Some have a state income tax, while Florida does not. This creates a very favourable business environment because not having to pay state income tax can save businesses a substantial amount of money. In New York, for example, businesses face not just state income tax, but also local and county taxes.

“People realised they could save eight to 10 per cent by moving to states like Florida,” adds Ackor. “It wasn’t just Florida, though. A lot of companies also moved to Texas, Tennessee and other Republican-run states with zero state income tax. Miami, in particular, is very vibrant with a diverse mix of people, including many wealthy individuals with the resources to buy yachts. The favourable tax environment combined with the beautiful surroundings makes it not just a place to do business, but also a desirable lifestyle.”

In light of this burgeoning financial prominence of Florida, our industry is poised to benefit, particularly as the beating heart of the superyacht industry lies but a train ride away from Miami. Often hailed as the ‘Yachting Capital of the World’, Fort Lauderdale’s renowned yachting infrastructure, combined with the wealth influx into Miami, presents sizable prospects for the industry.

“The US is an incredibly important market. It’s a crazy market, particularly at the moment,” says Jonathan Beckett, CEO at Burgess Yachts. The brokerage recently opened a new office in Miami’s Brickell area, also known as Wall Street South, in a bid to seize opportunities for new and existing owners in the region. The firm’s move to the city’s financial district to set up shop in a building that also houses tenants such as JPMorganChase and Boston Consulting Group follows the relocation of several hedge funds and tech companies.

“Of course, there is a bit of trepidation in the US at the moment regarding the election, which happens every time,” adds Beckett. “But that will be relatively short-lived and once the election is over, the market will move again. When you’ve been in the business for a long time, you simply factor [in] instances like this.”

Robb Maass, attorney at Alley, Maass, Rogers & Lindsay, adds, “Jonathan sees strength in the US market from a personal perspective. I think he’s refocused Burgess, not by moving away from Europe but by putting more resources and attention on the US market, which is just logical. We are an extremely wealthy country, not just in terms of average wealth, but also in terms of the individuals who have the resources to buy large yachts and are inclined to do so. There’s a lot of wealth in other countries but people aren’t necessarily as prone to buying large yachts as we are, and that’s something more and more businesses are starting to recognise.”

Following the Russian invasion of Ukraine, the resulting sanctions have effectively removed Russian UHNWIs from the majority of the industry – leaving a significant gap that North American buyers have been quick to fill.

Miami not only holds significant concentrations of wealth, but also serves as a cultural luxury epicentre, where it’s more a way of life than a commodity. For brokers, this concentration of affluence presents a golden opportunity, and in a market where relationships are paramount, understanding the geographic and cultural nuances of wealthy enclaves is vital.

Over the years, the distribution of UHNWIs has shifted significantly across the globe. In 2005, Europe was the dominant region, housing the largest proportion of the world’s wealthiest people. However, by 2023, North America had gradually overtaken Europe and is expected to solidify its position as the primary hub for UHNWIs by 2028. The region is currently maintaining its

lead, with the number nearly doubling from 81,700 in 2017 to a projected 161,280 this year. This substantial increase points to a favourable economic environment, particularly during the Trump administration, where economic policies significantly benefited the ultra-wealthy, leading to accelerated wealth accumulation.

Asia has also been on a rapid upward trajectory. Although Asia’s share of the global UHNW population was relatively modest in 2005, it grew significantly by 2023. Projections for 2028 suggest that Asia will see wealth concentration levels similar to North America’s. Asia’s UHNW population is also expected to climb from 59,900 in 2017 to 110,600 this year.

On the other hand, Europe is experiencing a relative decline. Although it remains an important market, the region’s share of the world’s ultra-wealthy is shrinking by comparison. Europe is expected to grow from 64,400 UHNWIs in 2017 to 111,500 this year, reflecting a stable, albeit slower, economic expansion compared to North America and Asia.

Source: SuperyachtIntelligence.com

The broader geopolitical landscape has further tilted in favour of the American market following the Russian invasion of Ukraine. The resulting sanctions have effectively removed Russian UHNWIs from the majority of the industry – leaving a significant gap that North American buyers have been quick to fill. The exodus of Russian superyacht owners has also led to their share taking up 8.1 per cent, down from 9.1 per cent last year. As a result, Russian ownership has not only decreased but the nation’s influence in the global superyacht market has also waned, further enhancing the US’s dominant position.

Wealth-X data confirms that this shift has bolstered the US market. This reallocation of wealth presents both opportunities and challenges for the industry. On the one hand, American buyers are stepping up to fill the void left by Russian clients, continuing to drive demand. On the other, brokers must grow and understand a slightly new landscape, where both traditional market dynamics have shifted and expectations of buyers have evolved. Understanding these nuances will be key to capturing the emerging opportunities in an already competitive market.

“The market has changed dramatically, and global wealth has increased significantly, says Maass. “This trend is expected to continue, with wealth continuing to rise worldwide. However, it doesn’t follow a straightforward upward trajectory, it’s more like a roller coaster, with peaks and valleys. But overall, the trend remains upward, and that translates to more people being in a position to purchase large yachts.”

Some in the industry have been more affected than others. Beckett explains that the loss of that demographic landed a weighty blow to Burgess, with the company losing 20 to 25 per cent of its clients seemingly overnight. “It’s about working harder in those markets,” says Beckett. “But this is one of the reasons I’ve gone to America: to rally the troops and perhaps recruit more people committed to making a real impact over here. The harder you work in the marketplace, the more success you have.

“As a broker, understanding the nuances of different cultures and people is key. For instance, Americans tend to be more enthusiastic about doing deals. They typically have more of a hunger and an appetite for closing a deal, and like credit. Europeans, on the other hand, are more cautious when approaching a deal and also tend to shy away from financing a yacht.”

Source: SuperyachtIntelligence.com

Source: SuperyachtIntelligence.com

Therefore, in tandem with the highest number of UHNWIs, it will come as no surprise that the US leads in ownership too, with 23.6 per cent of the world’s superyacht owners residing in the US as of 2023, an increase of 0.6 per cent from the previous year. The country’s preference for larger vessels is also on show, with an average length of 54 metres.

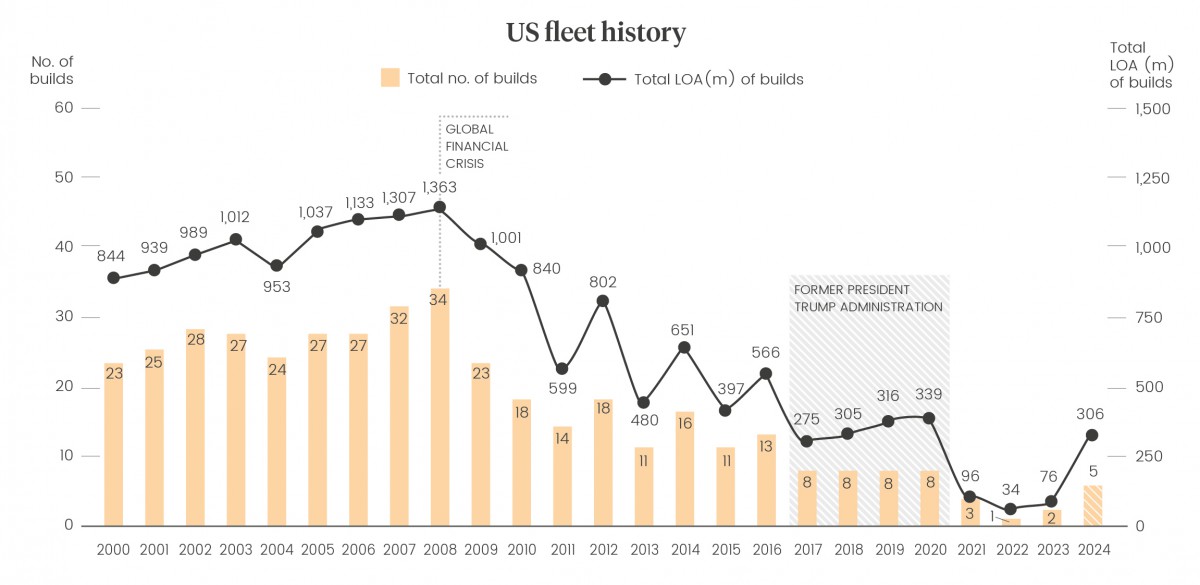

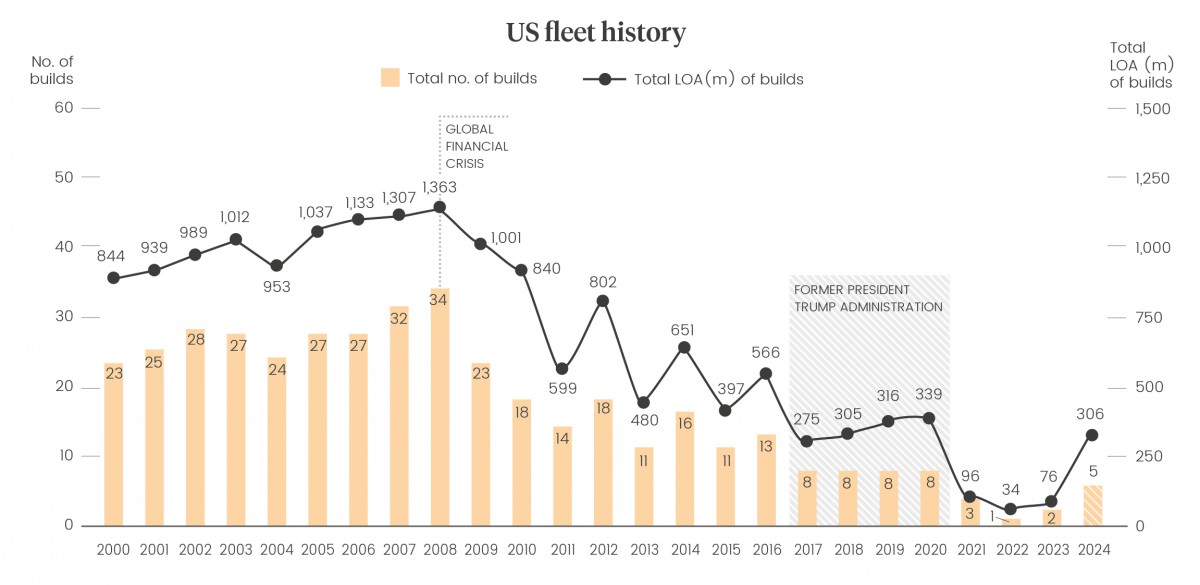

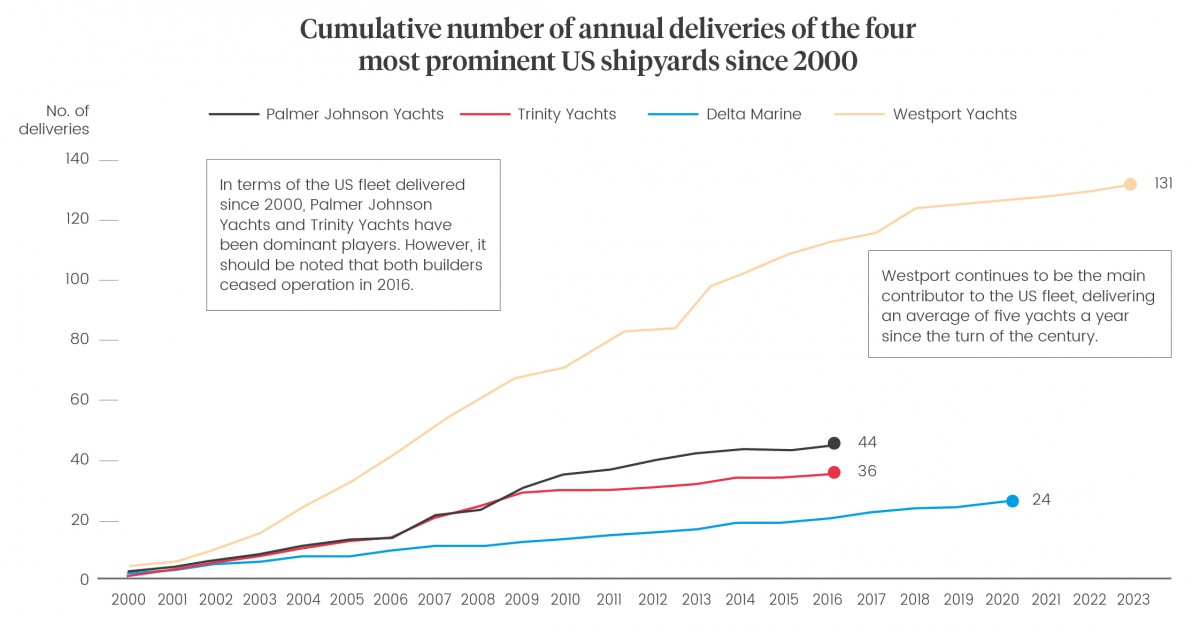

However, the prominence of American owners hasn’t translated into a thriving domestic new-build industry. The 1990s and early 2000s were periods of growth for superyacht shipyards in the US, with builders such as Westport, Christensen, Palmer Johnson and Trinity Yachts at the forefront, delivering some of the world’s largest and most highly acclaimed boats. But by 2008, the industry had hit the peak of its golden age before experiencing a sharp decline, largely due to the global financial crisis.

There was also a significant shift in the euro-dollar exchange rate, which at one point was close to 1.6. It’s now around 1.12 but back then, European builds were much more expensive for Americans, giving US builders a price advantage that’s since disappeared. That shift completely changed the market. “The American market at the moment is the European market when it comes to new yacht construction. More and more Americans are entering contracts to build boats in Europe,” says Maass.

“It’s much less of an American-dominated world in this industry now. We have very few yards still building large yachts, although we do have a lot of production builders. In terms of the number of boats built, if you include everything from bass boats to superyachts, we’re still number one in the world, but when it comes to large yachts, we’re just a fraction of what we used to be.”

Unlike other sectors that rebounded a few years after the financial downturn, the US new-build sector has struggled to return to its former production levels, with signs of recovery still elusive, according to Superyacht Intelligence data. By 2016, both Palmer Johnson and Trinity Yachts had ceased operations, and Christensen’s output had significantly diminished. The high costs of launching equipment and the geographic challenges of American shipbuilding further compounded the industry’s decline, leaving US shipyards struggling to compete with their European counterparts.

The decline of American shipbuilding aligns closely with broader deindustrialisation trends seen across the US. Since the mid-1990s, shipbuilding in the US has diminished exponentially, which has directly affected the superyacht industry and is vividly illustrated by the slump in deliveries and the number of active US shipyards. In 2008, at the peak of the market, US shipyards delivered 34 superyachts with a total length of more than 1,368 metres. However, by 2023, this number had plummeted to just two deliveries, with a combined length of only 76 metres.

The drop in the number of active shipyards from 16 in 2001 to just one as of 2021 poignantly hits home the dramatic contraction of the industry. While Delta Marine continued to make a small number of deliveries until 2020, it hasn’t built a boat since, although it is predicted to deliver a 44-metre yacht in 2025. Westport continues to be the major US shipyard, although production has slowed, producing an average of five yachts a year since the turn of the century.

This trend is exacerbated by the lack of subsidies and supportive economic policies in the US, making it difficult for domestic shipbuilders to compete on a global scale. Some countries continue to invest in their emerging industries through targeted initiatives. For example, the UK government has launched a new financing plan to support domestic shipbuilding, including yacht and superyacht yards. The Shipbuilding Credit Guarantee Scheme (SCGS) is a key component of this effort, where the government acts as a guarantor for up to 80 per cent of a shipping loan.

Robb Maass, attorney, Alley, Mass, Rogers & Lindsay.

The US government has failed to provide similar levels of support. The Jones Act further complicates matters by adding costs to US-built yachts, requiring goods transported between US ports to be carried on American-built, American-owned and American-operated vessels. This legislation has increased the cost of transporting yachts within the US, making domestic shipbuilding less competitive.

“Now [that] European boats are less expensive relative to American-built ones, the decision of where you’re going to build your yacht tends to be an easy one,” says Maass. “If the euro rises, that could change, and we might see growth in the domestic market in America again. But it’s unclear if that will happen. Once these yards go under or are repurposed, it would take a lot to regenerate that manufacturing capacity.

“It also would take a prolonged period of higher euro rates to make a significant difference, but I don’t see that happening any time soon. In a world that’s increasingly volatile, the dollar remains the refuge currency. In fact, there’s more US cash, particularly hundred-dollar bills, in circulation outside the US than within it. Under these conditions, it’s unlikely we’ll see a radical shift in exchange rates.”

There’s also a prevailing belief among some owners that European-built yachts are of superior quality, which has diverted attention away from US-built vessels. This perception is then reinforced by economic factors such as the exchange rate between the euro and the dollar, making European yachts more financially attractive to potential buyers.

Changes in the tax code, particularly those affecting income and luxury taxes, can also deter potential superyacht owners. Moreover, tariffs on imports to the US increase the cost of materials, pushing up the final price of a vessel and making US-built yachts less competitive. Maass vividly recalls a conversation he had with Paolo Vitelli, founder of Azimut Yachts, more than 30 years ago, just after he acquired Benetti. “He said that his dream, when starting out, was to build more yachts than Broward.” A dream that he has no doubt since achieved.

“I think American manufacturers could easily bring in some European talent but it’s very difficult to establish a new yard capable of building boats to the same quality you see in Europe overnight.”

Maass adds, “US builders have had to fight the perception that European yachts are of a higher quality. Once that perception exists, it takes a long time to dispel, and right now, it’s not particularly relevant because there aren’t many US manufacturers prepared to compete with European builders. I don’t want to say there aren’t any. For example, Delta is still building and they produce very high-quality boats.

“It will be difficult fort he US builders to come back. One of the problems is that when you have such a significant drop in capacity, your skilled labour goes off into other industries. The knowledge and experience gained from working in a shipyard for 30 years is something you can’t just replicate instantly.”

European builders have been doing well for decades, working with subcontractors and suppliers who have also been in the industry for a long time. You can’t just snap your fingers and recreate that. While importing talent from abroad could be a solution to boost the domestic market in the US, it’s not a straightforward option.

“For instance, I know that some Chinese builders have brought in non-Chinese middle-management types to assist with production, which is crucial because they oversee the younger labour force, and their supervision is probably the most important factor,” says Maass. “I think American manufacturers could easily bring in some European talent but, again, it’s very difficult to establish a new yard capable of building boats to the same quality you see in Europe overnight.”

Although the current state of the American new-build sector remains bleak, there are ways for the industry to reverse the decline. The simplest step is to communicate and show the market the quality of vessels that American builders produce. But to truly revitalise the industry, stakeholders need to take collective action and advocate for legislative changes that will support the sector to make it happen – and with the US election looming, that opportunity could be on the horizon.

“While I think Trump has been a disaster for America, damaging our international reputation and lowering our standing in the world, from a yachting perspective, he likely represents a better outcome in the election than Harris would.”

The upcoming election adds an extra layer of complexity to the fabric of the American market. Initially, many around the world anticipated a return of Donald Trump’s presidency because the polls seemed to favour the former businessman over current President Joe Biden. However, with Kamala Harris now the Democratic candidate following Biden’s decision to step down, the landscape has dramatically shifted.

“What I’m observing in my practice is a definite slowdown as we approach the election,” says Ackor. “Now there are likely several reasons for this. The wars in Europe, particularly the conflict between Ukraine and Russia, and the situation in the Middle East with Israel, are certainly not helping. These events are understandably unsettling. Then the uncertainty surrounding our political landscape and the upcoming elections is contributing to this slowdown.

“When Trump was leading by a significant margin, things seemed to stabilise somewhat. But now, with so much uncertainty, people are holding off. It’s very clear to me that transactions have slowed but I don’t think it’s because people lack the money. It’s more that they want to see what’s going to happen.”

The economic policies of Trump’s presidency had notable effects on the wealth of the industry’s primary clientele, which in turn influenced the superyacht market. Post-election, the US economy experienced a surge in business confidence due to expectations of favourable economic policies under the Trump administration, with the Dow Jones Industrial Average rising by 4.2 per cent in just two months after his inauguration.

A key piece of legislation from his tenure was the Tax Cuts and Jobs Act of 2017, which lowered the corporate tax rate from 35 per cent to 21 per cent. This was intended to stimulate economic growth by increasing corporate profits and encouraging investment. However, it’s important to note that while these tax cuts did benefit the wealthiest individuals, the broader impact on the economy was more modest.

Erin Ackor, partner, Moore & Co, and president, International Superyacht Society.

In terms of what this meant for the superyacht industry, this policy not only boosted corporate profits, but also led to increased stock buybacks, further elevating share prices across the US. It meant that many potential buyers – who are, more often than not, business owners or major shareholders – saw a significant rise in their wealth, thereby enhancing their ability to invest in, and purchase, assets such as yachts.

There’s also a whole sector of young people involved in the cryptocurrency environment. Trump is, if not very pro-cryptocurrency, at least supportive of it and is also pro-deregulation, which contrasts with the Biden-Harris administration which is much more focused on regulation. We could speculate that a Harris administration could still support a new era of superyacht buyers but marked by increased environmental consciousness. However, the potential for tax reforms and heightened economic uncertainties is more likely to lead initially to a more conservative approach to spending, affecting how and when UHNWIs decide to invest in the industry.

There are also fears of what it would mean for the supply chain and the wider industry in the US if Harris was to hike taxes. “I would be concerned that businesses that feed into the industry would be hit very hard by tax increases,” says Ackor. “With increased taxes and regulation, it becomes really difficult to sustain a small business. The superyacht industry feeds into so many livelihoods, and that’s one of our biggest strengths. The economic impact we have on communities, especially in South Florida, is massive, with so many people working in the industry. If these small businesses are taxed more heavily, it would be a real challenge.”

For Ackor, more regulation and higher taxes won’t help the situation. In terms of what she sees in her practice, from a purely economic standpoint, a Trump administration would likely lead to greater stability, a more vibrant economy and more opportunities for people, and with a booming industry there’s more opportunity to innovate and solve issues that the industry faces in other areas.

“If Trump gets elected again, I think we’ll see a boom. When people see the economy stabilising, it gives confidence to the markets, and that’s where you see the superyacht industry flourishing.”

“We don't know what Harris is planning policy-wise,” says Ackor. “It’s interesting because, in my opinion, people are in a holding pattern. I have many clients with boats for sale and nobody is buying all of a sudden. This seems to have started in the last two or three months. There was also a bit of a blip when Trump’s poll numbers shot up and people thought he was going to win.

“Things seemed to normalise for a while and we started seeing more transactional deals come through. But now, everything has stopped again. When times are great, we have a busy transactional department, and similarly, when times are tough, we have a booming litigation practice.” And the latter seems to be the case at present, she says.

Ackor adds, “If Trump gets elected again, I think we’ll see more of an economic boom. When people see the economy stabilising, it gives confidence to the markets, and that’s where you see the superyacht industry flourishing. There’s more money being made. The superyacht industry as a whole provides significant economic support to so many, and it’s important that we take this into consideration.”

Maass reluctantly agrees, but only up to a point. “I have mixed feelings about this because while I think Trump has been a disaster for America, damaging our international reputation and lowering our standing in the world, from a yachting perspective, he likely represents a better outcome in the election than Harris would.

“However, even though this is my business and my industry, I believe there are other reasons why we should be considering someone other than Trump. It’s not all about the wallet. There are intrinsic values that are extremely important. I don’t believe in people voting solely based on their financial interests.”

Worldwide economic factors have a part to play too. Recent stock-market activity witnessed severe fluctuations, which could be a cause for concern. In early August this year, global markets experienced a sharp downturn, largely triggered by Japan’s decision to raise interest rates, which led to the unwinding of the yen carry trade – a strategy that investors had relied on for stability. This, combined with disappointing US jobs market data, which showed much weaker growth in non-farm payrolls than anticipated, spurred fears of an impending recession.

Regardless of the election and economic volatility, collaborating across the industry is key, and tackling issues that face our industry directly head on should remain our focus.

For yachting, this market instability could have several implications. Historically, fluctuations in the stock market have directly impacted the purchasing power and investment behaviour of UHNWIs. Therefore, a prolonged period of market volatility, such as the one we’re currently seeing, could be another reason leading to more conservative spending patterns among these individuals, dampening demand for yachts. The full impact will depend on whether these recent market disturbances mark the beginning of a longer-term trend or if they are primarily driven by short-term factors.

“So far, however, at least for us, it really hasn’t had much of an effect. We’ve been involved in a number of very large new builds this year. But what I’ve always said is that buying a boat isn’t necessarily about money,” says Maass. “There’s always money out there. There’s a tremendous amount of wealth in the world, and a lot of it is still untapped when it comes to the yacht market. What causes a person to buy isn’t whether they’re able to, but whether they’re in the right frame of mind. It’s more about psychology than ability. In times of volatility or uncertainty, that mindset can change.”

Regardless of the election and economic volatility, Ackor maintains that collaborating across the industry is key, and tackling issues that face our industry directly head on should remain our focus. “Superyacht owners are key, and they’re generally very interested in finding ways to be more environmentally conscious,” she says.

“At the moment, we have a lot of resources and superyacht funding, but that will change over time. The US won’t always be the leader in yacht ownership. Things shift globally, and there are many owners in places like England, which has a significant yacht ownership population. We’re also looking at emerging markets like China, the Middle East and others. But we need to figure out how to work productively with these markets and promote sustainability together. Yacht owners are leaders and innovators and have the wealth behind them to help us effect change, including developing more sustainable solutions for the future.”

Despite some trepidation, many remain cautiously optimistic. Wealth is expected to continue its upward trajectory and having navigated previous economic storms, the industry is likely to follow suit. As the brokerage sector expands across the US, increasing exposure to the benefits of yachting, the market stands to gain from this momentum. And although current economic and geopolitical factors will continue to contribute to volatility in the market, staying informed and drawing lessons from past experiences will all but secure the industry’s future in the United States and beyond.

“This year is softer due to the American election, the election in France, the war in Russia and Ukraine, and the Israel-Gaza conflict. The economy in Europe is also a bit shaky. But the US and global brokerage sector is in a good place, though it may not reflect the same highs of the last two exceptional years,” explains Beckett.

Maas concludes, “As the saying goes, ‘It’s the economy, stupid’. If people are confident, they will buy. It’s a matter of psychology. If the world calms down a bit, people will buy more. But if we end up with more regional conflicts, especially in the Middle East, and if the situation in Ukraine continues, those are not good factors. So we have to watch that. However, if you look at things over a longer time horizon, I believe the yachting industry still has a bright future.”

This article first appeared in The Superyacht Report – Owner Focus. With our open-source policy, it is available to all until 21 November by following this link, so read and download the latest issue and any of our previous issues in our library.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Is the auction above board?

With negotiations underway for Royal Romance to be sold at an American auction house, a Ukrainian law expert offers insights on the contentious move

Fleet

What is the future of ownership?

Martin H. Redmayne quantifies the potential for new ownership based on the number of individuals who could afford to enter the market

Owner

Understanding VAT in yachting

Miguel Ángel Serra, Founding Partner of Legalley+, examines the complexities and misconceptions surrounding VAT in Spain

Business

The case of Masters vs USA

Further details have emerged concerning the indictment of Richard Masters

Business

Related news

Is the auction above board?

11 months ago

What is the future of ownership?

1 year ago

Understanding VAT in yachting

2 years ago

The case of Masters vs USA

2 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek