The Italian impact

Altagamma-Deloitte's study shows the Italian sector contributes €27.7 billion annually and employs around 157,000 people, with further untapped potential…

The Italian nautical industry grew three times faster than the country’s GDP between 2012 and 2022, according to findings from an Altagamma-Deloitte study. The sector’s overall impact is also almost three times its direct economic impact and six times its employment impact. There is, however, room for further unexpressed potential.

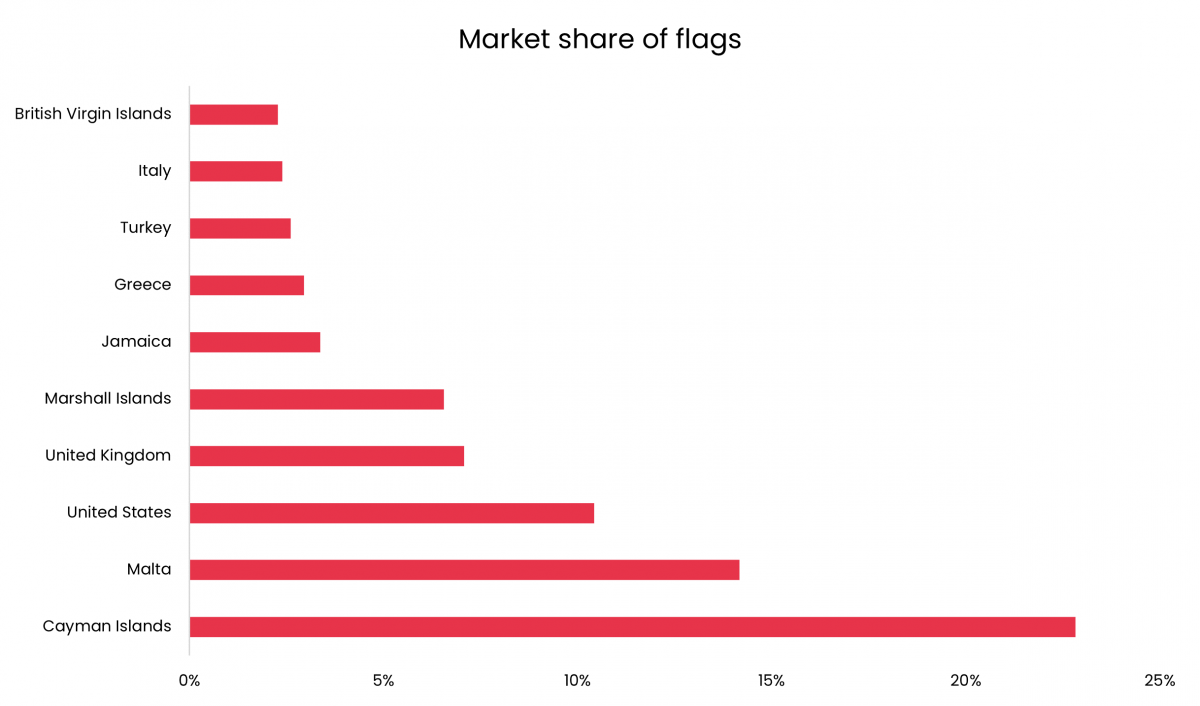

“The analysis shows not only the value of the Italian nautical industry but also the untapped potential of a sector with significant growth margin,” says Giovanna Vitelli, Vice President of Altagamma’s nautical sector and Chair of the Azimut|Benetti group. “Although Italy is the world leader in superyacht construction, only 6 per cent of these vessels fly the Italian flag. This limits the positive impact superyachts can generate locally.”

The Altagamma-Deloitte study, ‘La nautica da diporto in Italia’, dissects the economic and employment influence of Italy's nautical sector, the global leader in the construction of yachts over 24 metres. The analysis covers both shipbuilding and marine tourism, examining factors from the production and maintenance of yachts to their subsequent use and the benefits generated by their presence along Italy's coastline.

The study shows that yachting is a key economic driver for Italy, contributing €27.7 billion and employing around 157,000 people in 2022. It then leverages tourism and the ‘Made in Italy’ brand, resulting in a 2.7 multiplier effect. This means every euro spent directly in yachting generates an additional €1.70 in related industries. Some 59 per cent of the total impact was generated by the use of yachts, 38 per cent by new builds and 3 per cent by refits.

The sector also has an implicit employment multiplier, supporting six jobs indirectly for every one job created directly. These impressive figures highlight the necessity of discussing further growth opportunities for the sector and its entire value chain, with a particular focus on activities connected to the use of yachts, which currently account for over half the maritime sector’s total value.

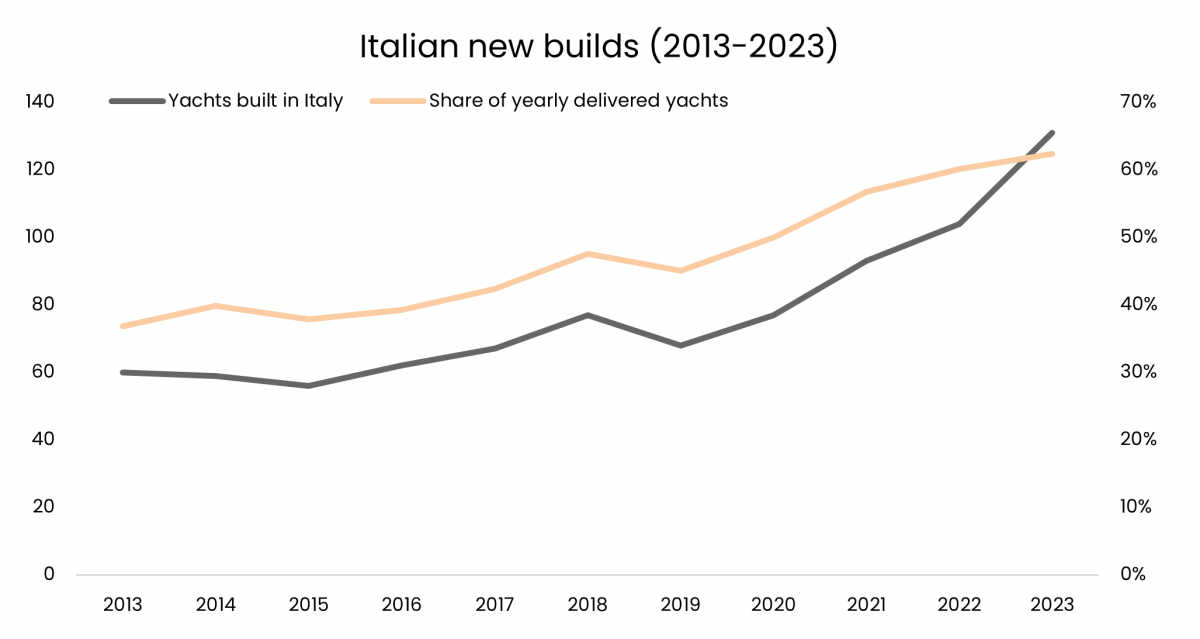

For example, new builds and refits generate a direct economic impact (OPEX) of €4.4 billion, mainly from the purchase of components and sub-supply services. For context, Italian new-build production over 24 metres represents around 50% of the global superyacht fleet. The total impact, including direct, indirect and satellite effects, is about €11.4 billion, supporting 54,300 people. This results in an economic multiplier effect of 2.6 and an employment multiplier effect of 5.6. Notably, 92 per cent of the economic impact comes from companies associated with new builds.

An even greater impact is seen in the influence of yachts and marine tourism on local areas. In 2022, the global superyacht fleet (over 24 metres) reached 6,400, with 30 per cent (around 2,000) visiting Italian coasts. ‘Superyachts’ (24 to 59 metres) spend €10-100K a week, while ‘gigayachts’ (over 60 metres) spend up to five times more. In 2022, the fleet's direct economic impact was about €5.9 billion, with 35 per cent from tourist spending. The total impact (direct, indirect and satellite) was about €16.3 billion, supporting 103,000 jobs. This translates to an economic multiplier of nearly three and an employment multiplier of 6.1.

Onshore spending by yachts is, on average, 26 times greater than the nautical sector’s average, making it a significant economic and employment driver for Italy. This sector attracts a global niche market of high-spending consumers, translating into considerable social and economic value. This potential is even more significant considering that only 6.5 per cent of these superyachts are registered under the Italian flag.

The study indicates that a large yacht registered in Italy, with an Italian crew and visiting the country’s coastline for at least 10 weeks per year would contribute an annual sum of €1.6 million. So increasing the number of yachts visiting or residing in Italy could significantly boost the economy and employment levels.

For example, Italy’s production achievement of 5,000 yachts over 24 metres in the last 50 years; however, there are only 172 registered under the Italian flag. If each of these yachts employs an average of 10 sailors, it potentially creates 10,000 direct crew jobs and a further 60,000 indirect jobs if 1,000 Italian-flagged yachts were registered - just a fifth of the country's output.

Another key opportunity for expanding satellite activities linked to yachting is the development of marinas. Currently, only 30 per cent (about 166,000) of the berths available in Italy are in marinas equipped to receive yachts and superyachts, offering the necessary technical and tourism facilities to cater to this market.

“Hence the need to intervene to increase the attractiveness of Italian registration and chartering on our coasts, bringing VAT into line with hotel activity, and also our marinas, which are real destinations for marine tourism,” says Vitelli.

Vitelli also calls for updating regulations and procedures concerning Italian Flag registration relative to international Flags, aiming to enhance its appeal. Simplifying bureaucratic procedures, particularly those related to crew recruitment checks, is another crucial aspect of Altagamma’s strategic plan to stimulate growth in the sector.

While Italy might lead in production there is room for further growth and benefit from increased demand both domestically and internationally. Key areas for development include specific legislative measures to make the Italian Flag more attractive, greater investment in port infrastructure and related services, improvements in technical and management skills, and the creation of more innovative and sustainable platforms.

“Therefore, it is essential to make Italian registration and chartering on our coasts more attractive, align VAT with hotel activities, and enhance our marinas, which are genuine destinations for marine tourism,” adds Tommaso Nastasi, Senior Partner of Deloitte Italy, adds. “Yachting is a strategic sector for Italy, contributing economically and benefiting other 'Made in Italy' sectors and tourism. Enhancing nautical services and tourism can generate substantial benefits for the Italian economy.”

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Sanlorenzo sign €91.5 million sustainable development agreement

The Italian shipyard will work alongside local government to implement an industrial investment programme

Business

Full speed ahead

With four acquisitions in 10 months, Quick Group’s rapid expansion into new markets looks to bring Italian craftsmanship to all four corners

Business

Creating a new nautical code

Pietro Angelini, General Director of Navigo, on his proposal to introduce a new nautical code in Italy

Business

RINA reports double-digit growth

The Italian classification society made around 800 million euros in revenue during 2023 and now plans to reach €2 billion by the end of the decade

Business

Sanlorenzo appoints Ferruccio Rossi and confirms Q1 financials

After his resignation last month, Ferruccio Rossi has been appointed CEO of the newly established Sanlorenzo Monaco Group

Business

Piero Formenti to head Confindustria Nautica

The former senior vice president of Confindustria Nautica will lead the association as president following Saverio Cecchi's self-suspension

Business

Related news

Full speed ahead

1 year ago

Creating a new nautical code

2 years ago

RINA reports double-digit growth

2 years ago

Piero Formenti to head Confindustria Nautica

2 years ago

Billions in the Balearics

2 years ago

Ferruccio Rossi steps down

2 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek