The year of the Tiger

Is the Chinese superyacht market beginning to come of age?

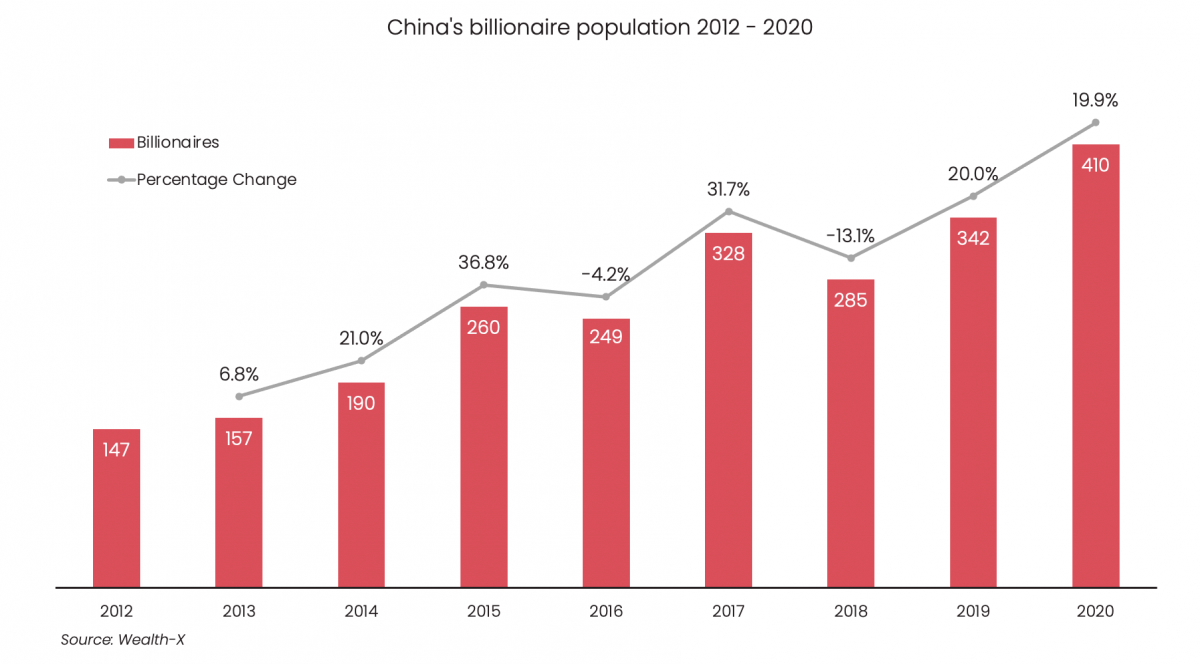

It is no secret that the superyacht market, generally speaking, has had an issue with converting the growing UHNW population into superyacht owners and this is perhaps nowhere more telling than in China. With a booming UHNW population and a relatively untouched superyacht market, when compared to the main buyer hubs, it has long been assumed that China represents that next large growth market for the superyacht industry. Using content originally published in The Pacific Superyacht Report, we consider the opinions of some of the market’s most renowned experts on Chinese yachting culture and trends.

“There is definitely an upward trend in the superyacht market in China, as the wealth of the mainland Chinese increases,” explained Joe Yuen, of Lodestone Yachts. “The Chinese tend to purchase new superyachts from production yacht dealers, but now you see more and more Chinese buying semi-custom or full-custom superyachts through professional yacht brokers. The production yacht dealers have done well with their marketing in the region, and you are also beginning to see larger semi-custom superyachts cruising in the harbours.”

The most prolific yachting market in Asia is undeniably Hong Kong and it is through this market that many Chinese buyers have found their foothold in the superyacht market. However, Hong Kong’s superyacht market has limitations, not so much with regards to wealth and market potential, but with regards to marina capacity. The vast majority of berths in Hong Kong are below 35m and, as a result, those Chinese buyers that aspire beyond the production markets have been required to look elsewhere and, influenced by the European yachting centres, have begun to increasingly move towards larger projects.

“Hong Kong is already a very mature yachting market, so there isn’t much potential for growth. While mainland China is already very active, it will be growing rapidly in the next 10 years,” explained Rock Wang, Feadship’s Asia representative. “Buying a yacht is more expensive in the 35-60m size range, so clients spending this much money tend to want something new. About 60- 70 per cent of these clients will choose a new build. Most clients also don’t want to wait too long for their yacht, but thankfully many shipyards offer production or semi-custom models in this size range, which shortens build time.”

Regardless of time constraints, however, Wang revealed that most Chinese buyers prefer new vessels: “The vast majority of clients want a new-build when buying a yacht over 60m. Every yacht of this size has a very specific personality and, because of this, many of the clients I have worked with feel that a second-hand yacht of this size does not and would not belong to them. It is the Chinese mentality; if they are spending 20-30 million euros, they want something new.”

The traditional conception of Chinese buyers is that they have been constrained by various societal norms, such as a lack of holiday, a focus on business and a desire to keep their wealth a secret within a communist nation. However, the more the superyacht market develops in the region, the further these assumptions seem from the reality of the situation.

“One thing I have noticed in China, as the country has developed, is that tradition does not hold people back,” commented Mike Simpson, managing director of Simpson Marine. “The Chinese are adventurous and they are quick to pick up on new ideas and develop them. Chinese buyers quickly appreciated that yachts were great for entertaining friends and business associates, but with the growth of water sports, the ability to carry tenders and toys has become increasingly important. The adventurous nature of the Chinese has also led to interest in expedition yachts.”

Another one of the traditional holdups in the development of the Chinese superyacht market, at least where it relates to domestic ownership, has been the exorbitant tax requirements for importing superyachts that were built and/or flagged outside of China. However, with the development of the Hainan Free Trade Port, this is also changing.

On 15 December 2021, Simpson Marine sold a Sanlorenzo SX76. While this would not typically be considered news worthy as the sale doesn’t meet 30m-plus the size requirement to feature on SuperyachtNews, this sale is in fact significant owing to it being the first vessel of its kind to be sold in Hainan’s Free Trade Port.

“…the sale of another SX76 has recently been concluded for delivery into Hainan’s resort city of Sanya. Sanya’s special Free Trade Port (FTP) benefits owners as there is no tax policy while a boat is operating as a charter vessel in China. Hainan’s Free Trade Port is set to be one of the most open and internationalised zones in the region. It is trade and investment‑friendly, boasts a robust legal regime, maintains a comprehensive financial services sector, and demonstrates safe and efficient oversight. A very appealing overall package for yachting,” explained a Simpson Marine announcement.

For so many years the superyacht market has looked towards China with eager anticipation, only for so many businesses to be initially disappointed by the region’s slow yachting development. However, with various commentators highlighting the growth in popularity of superyachting on the part of Chinese buyers, not to mention an operational free trade port, perhaps the year of the tiger is the year that the Chinese superyacht market will finally come of age.

To gain access to our full suite of past, present and future reports, click here to become an Essential Member. For just £10 per month, members will gain unlimited access to high-impact journalism on SuperyachtNews, a subscription to The Superyacht Report, including access to our complete library of back issues, The Superyacht Group Library, and unlimited access to the SuperyachtIntel database.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

.jpg)

The art of placemaking

How Porto Montenegro, with the addition of Adriatic 42, became a case study in placemaking for superyachts

Business

SkyStyle

We speak to the design team behind 71m UNIQUE to better understand its design philosophy

Fleet

.jpg)

Bi-weekly brokerage analysis

The next in our series of brokerage updates comes as strong sales continue in the second half of January

Fleet

The fleet forecast

We provide a snapshot of superyacht delivery figures for the next five years using three forecasting models

Fleet

Due diligence and bargain hunting

In light of Queen Anne being sold at auction, we consider the auctioning system and the risks and rewards therein

Owner

In defence of a (more) frugal superyacht

Is the superyacht industry missing a trick? Is more always more?

Business

Related news

The art of placemaking

3 years ago

SkyStyle

3 years ago

Bi-weekly brokerage analysis

3 years ago

The fleet forecast

3 years ago

Due diligence and bargain hunting

3 years ago

In defence of a (more) frugal superyacht

3 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek