A buyer’s guide to the 30-50m sailing yacht segment

This sector in decline still has a variety of options for the prudent buyer…

While a number of years ago the 30-50m sailing yacht sector was considered to be a relatively popular and competitive sector, the market today is quite different. As the superyacht market opened up to new demographics of UHNWIs the movement away from traditional sailing and towards the motoryacht sector hastened as most chose to engage with an asset class that was deemed to be more flexible and practical as the sailing yacht experience became less and less about the sailing itself and more about the various luxury pastimes that go hand in hand with the contemporary superyacht lifestyle. As a result, the legitimate options for 30-50m sailing yacht buyers today are few and far between.

Indeed, in the period from 2000-2012, the 30-50m sailing yacht sector delivered on average 21.5 projects per year, with a peak of 29 (2009) and a trough of 12 (2001). While this 12-year time period may seem arbitrary, 2012 is widely considered to be the final year that legacy projects commissioned before the global financial crisis were delivered. In the years that followed, this sailing yacht market declined rapidly. From 2013-2019, there was an average of 10.7 vessels delivered in this segment per year, with a peak of 17 (2013) and a low of six (2017). All told, the market has declined by around 50 per cent in recent years.

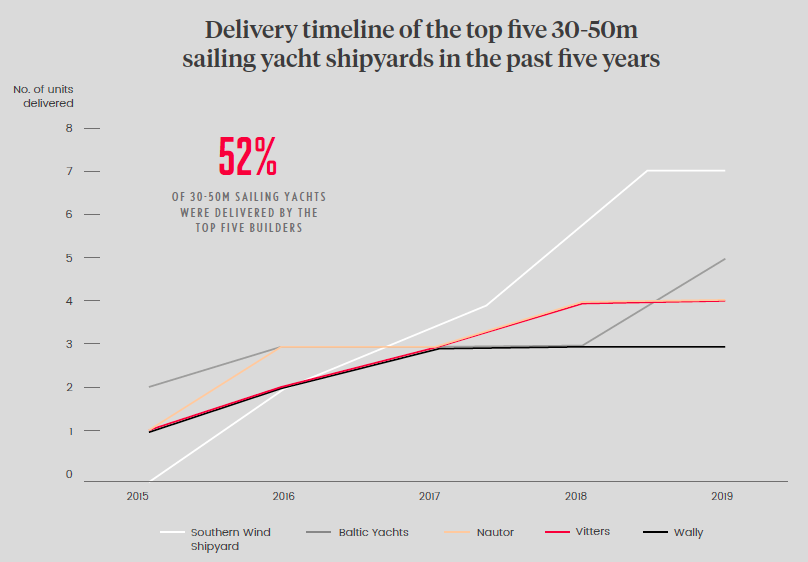

Such has been the sporadic nature of this sector in recent years, using a 10-year delivery cycle to analyse performance would be ineffective due to the number of ‘top-performing yards’ that are no longer operational. A five-year cycle, therefore, is of far greater use. Of the top-performing builders in this sector, Southern Wind Shipyard stands out having delivered seven projects in the last five years, followed by Baltic Yachts that has delivered five projects.

This is not to say, however, that build slots are hard to come by in this sector. While orders and deliveries are certainly down, a number of the shipyards that are known for building in this range have refocused their efforts on more popular size ranges. Therefore, when approaching a build in this sector it pays to be aware of the performance of certain shipyards across a range of sectors, rather than entirely putting stock in the results of the 30-50m market.

While new orders and deliveries are not what they once were, deliveries are outperformed by sales, which suggests there is still an active market for these vessels, albeit not necessarily new projects. In fact, between only the top five brokerage houses, dominated by Northrop & Johnson, more vessels in this range were sold than were delivered by the entire market between 2015-2019, suggesting that when extrapolated out to include other brokerage houses, a more active market emerges.

To explore the performance of the 30-50m sailing yacht sector including deliveries, sales, age vs final asking price, depreciation rates and more, be sure to download your complimentary version of ‘A Buyer’s Guide to the 30-50m Sailing Yacht Segment’ and click here.

Our Superyacht Market Reports have been created by Superyacht Intelligence, our team of in-house market analysts. With insight and data spanning every sector of the industry, the team is available to support the most bespoke strategic requests. If you are seeking unrivalled insight into a segment of the market, click here to download a free report outlining the scope of our services.

Profile links

Northrop and Johnson (Brokerage)

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Turquoise introduces Rainbow II

The 51m sloop is under construction and pays homage to the classic yacht of the 1900s

Fleet

The Buyer Journey: What makes a great spec

Advisors within the new-build sector discuss buyer best practice in terms of writing specifications

Owner

55m Project Gemini under construction at Heesen

The project is available for delivery in Autumn 2022

Fleet

The Buyer Journey: Deciding on new builds

Advisors within the new-build sector discuss buyer best practice in terms of choosing a shipyard

Owner

Hydrogeneration: crossing oceans without a drop of fossil fuel

Baltic Yachts is enabling its clients to dramatically reduce their environmental footprint and fuel costs

Technology

A buyer’s guide to the 90m-plus motoryacht segment

This growing market now offers buyers more choice than ever before

Fleet

Related news

Turquoise introduces Rainbow II

5 years ago

The Buyer Journey: What makes a great spec

5 years ago

55m Project Gemini under construction at Heesen

5 years ago

The Buyer Journey: Deciding on new builds

5 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek