The year in review

And a look to the year ahead…

So, the year is almost at an end, and as ever, its denouement brings with it reflection about what has come to pass, and what we hope will be next year.

We spent much of The Superyacht Forum talking about the next 10 years, in the broader context of society’s cultural imperative to save the world. This was most welcome, as it indicates a profound, industry-wide shift towards environmental and social governance (ESG). And there are both challenges and consequent market opportunities, ahead to deliver superyachts whose performance is better optimised, for greater operational efficacy.

But while future thinking is inspiring, it’s also important to reflect on the here and now.

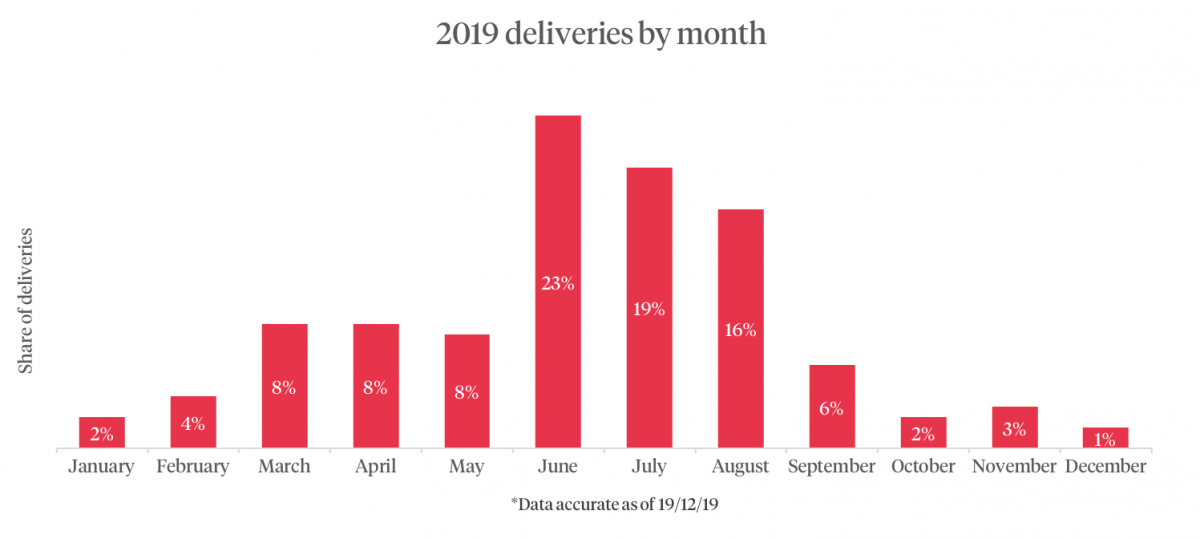

It has been another year of consistency for the superyacht industry. When reviewing the new build statistics on 19th December, there were 142 confirmed deliveries for the year, which based on that figure, could theoretically bring the final figure to c. 147. I estimate the final figure will actually be greater, as we know of the propensity for deliveries to be tied in with festivities.

Thus, the new build market, YoY, is broadly where it was in 2018 – give or take a handful of units. The average LOA of vessels delivered this year has fallen somewhat, from 45.8m in 2018, to 44.3m in 2019. This is somewhat surprising, as the higher echelons of the market have proven more robust in recent times. But it points to a slight contraction of the market as a whole, rather than any shift in activity between size sectors.

Where there has been a bit of a slowdown is within the resale market. By 19th December, there were still 31 fewer transactions than 2018 year-end, with a total market capitalisation of €210 million less. Where the market has seen growth, however, is the average value per vessel, which has risen by €300,000, to €11.6 million.

While the above is much for muchness, our projections for the year ahead begin to uncover a troubling trend. Projected 2020 figures actually add gravitas to the nominal slowdown experienced in 2019.

Indeed, forecast figures for the year estimate a final new unit delivery figure of 144, with projected second-hand sales of 191. If these figures were to be realised, it could well point to two consecutive years of market contraction, which in itself is at least worthy of note.

What has not been factored in within this article is the refit market, which has enjoyed pronounced growth. So, while this market rises, and the industry’s other two key performance metrics fall, it is fair to decide that those already in the market are doubling down with their existing vessels.

And that brings us back round to the aforementioned ‘future thinking’. Perhaps, as we enter a new decade, it is time for someone to seize the day; to stop talking about alternative ownership models and start introducing them. Client interest may well be piqued, and as I said at the top of the page, market challenges also represent market opportunities.

*all data supplied by The Superyacht Agency's Intelligence division.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek