A decline in active Turkish shipyards?

An update on the state of Turkey's new-build sector…

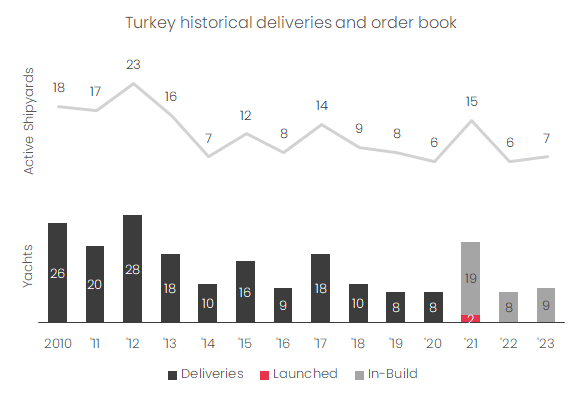

One of the most-read pieces of intelligence published on SuperyachtNews last year questioned the stability of the Turkish new-build market. Based on data provided by The Superyacht Agency, the article argued that the market looked to be heading towards a period of consolidation, with the number of shipyards far outweighing a decreasing number of deliveries in recent years.

At the time of publication, the Turkish order book looked healthy, with 24 projects scheduled for delivery in 2020 and 16 projects scheduled to be delivered in 2021, compared to a total of eight projects delivered in 2019. However, as mentioned at the time, these numbers seemed unrealistic considering that the 24 projects expected for 2020 were to be delivered from 14 different shipyards, when only eight shipyards delivered eight yachts in 2019, and nine shipyards delivered 10 yachts the year before.

The scepticism turned out to be justified: by the end of 2020, Turkey delivered just eight projects from six yards – a third of what was scheduled. Theses eight deliveries were made by Mengi Yay Yachts, Venture Yachts, Yildiz Gemi, Turquoise Yachts, Tansu Yachts and Numarine. It is worth noting that Perini's Yildiz Gemi shipyard was sold to new owners earlier this year and does not intend to resume the construction of yachts.

With 38 projects currently in the Turkish order book, and 21 of those scheduled to be delivered in 2021 from 15 yards, the same scepticism can be applied. In fact, according to The Superyacht Agency, there have been no deliveries made out of Turkey yet this year.

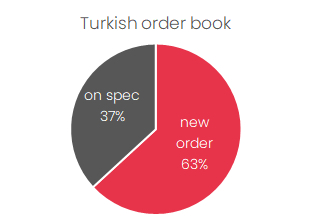

Of course, it is important to note, that the overly-optimistic order book is also reflective of the fact that a significant proportion of Turkey’s new-build fleet is built on speculation. According to The Superyacht Agency, 37 per cent of Turkey’s current order book is being built on speculation and, by their very nature, these projects have uncertain delivery dates that are dependent on an interested client committing to a purchase.

It’s early days, but delivery numbers in the past few years indicate that the Turkish new-build market might have settled on a new level of consistency of around eight deliveries annually. With many projects being built on speculation, it’s also possible that an uptick in sales could quickly bolster these numbers. However, with a consistently high ratio of shipyards to actual deliveries, compared to a decade ago, it’s still a concern that the number of shipyards in the country is not sustainable to support its domestic supply chain.

The Superyacht Agency is here to meet the demand for superior data-driven decisions in the superyacht market. While the intelligence database forms the backbone of its offering, it is only the gateway to what The Superyacht Agency’s intelligence team can offer. Click here to learn more about the work conducted by The Superyacht Agency.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek