Chartering with Monegasque rental solution approved

Approval has been granted by Monaco, France, Italy and Spain for vessels using the Monaco structure to charter in their waters…

The Monegasque rental solution is an ownership solution for owners who wish to defer payment of VAT on the purchase of their superyacht. Owners that utilise the structure are compliant with their obligations to the Monegasque government as VAT is paid to them during the life of the structure. The superyacht will be in free circulation throughout the EU. The Monaco Tax Authorities, Services Fiscaux, have confirmed that all yachts under the Monaco VAT deferment plan will now be able to engage in “occasional charter”, representing a reversal in their previously held position.

“This seems to follow a relaxation in general which allows VAT paid yachts to charter as well as those on commercial registration,” explains Ken Griggs, director of Dominion Marine. “It must be remembered, however, that superyachts under the Monaco VAT deferment plan are not VAT paid, merely VAT deferred, but on the other hand all the vessels are fully imported and in free circulation.”

Due to these points of difference, there have been some light restrictions imposed. As charter is not intended to be the main purpose, the vessels may ‘only’ charter for up to 84 days a year. A fiscal representative must also be appointed to collect the VAT due on the charter and there may be no reclamation of VAT on supplies.

“Following the grant of this consent from Monaco, we took the matter up with Customs in Nice who confirmed that they too were happy to see vessels under the deferment solution charter,” continues Griggs. “They further confirmed that any reference to YET was an irrelevance (as our yachts were imported and in free circulation) and only applicable to TAR vessels. This is an important distinction as it allows charter to both EU residents and non-EU residents alike.”

Upon confirmation that vessels using the Monaco VAT deferment solution will be allowed to charter in France and Monaco, Griggs set about discovering the answers to three important questions:

Can a yacht under Monaco VAT deferment start a charter in France/Monaco and…

a. Visit Spain/Italy/Greece without embarking or disembarking guests?

b. Visit Spain/Italy/Greece and embark or disembark guests?

Can a yacht under Monaco deferment…

c. Start a charter in Spain/Italy/Greece paying VAT on the charter to the relevant country?

The answers, thus far, are as follows:

Spain: Yes, to all three. However, where ‘c’ is concerned permission is subject to the vessel obtaining a charter license and cruising permit.

Italy: Yes, to both ‘a’ and ‘b’. Not to ‘c’.

Greece: No, to all.

Griggs is currently waiting on a further reply from the Croatian authorities.

In light of recent action taken against the Maltese and Cypriot leasing structures, the Monegasque VAT deferment solution has come to the forefront as a viable alternative structure.

Speaking with SuperyachtNews in 2019, Griggs explained that: “Every solution has a shelf life. The Isle of Man Leasing solution was around for 15 years and the Maltese Leasing Scheme was around for 12-13 years. What the Maltese and Cypriot leasing structures had in common is that they were desperately trying to give you a VAT paid superyacht at a deep discount. The Monaco solution doesn’t go anywhere near a VAT paid vessel, it has a completely different aim. What owners are really looking for is free circulation of their vessel.”

“This comes at a good time for those owners of commercial yachts faced with the abolition of “use and enjoyment” by the EU commission as those owners face a doubling (in the case of France) of the amount of VAT payable on own use. By entering into Monaco VAT deferment owners can enjoy 365 days use without the need for individual charter contracts at a fraction of the VAT otherwise payable….and still have the ability to engage in third party charter,” concludes Griggs.

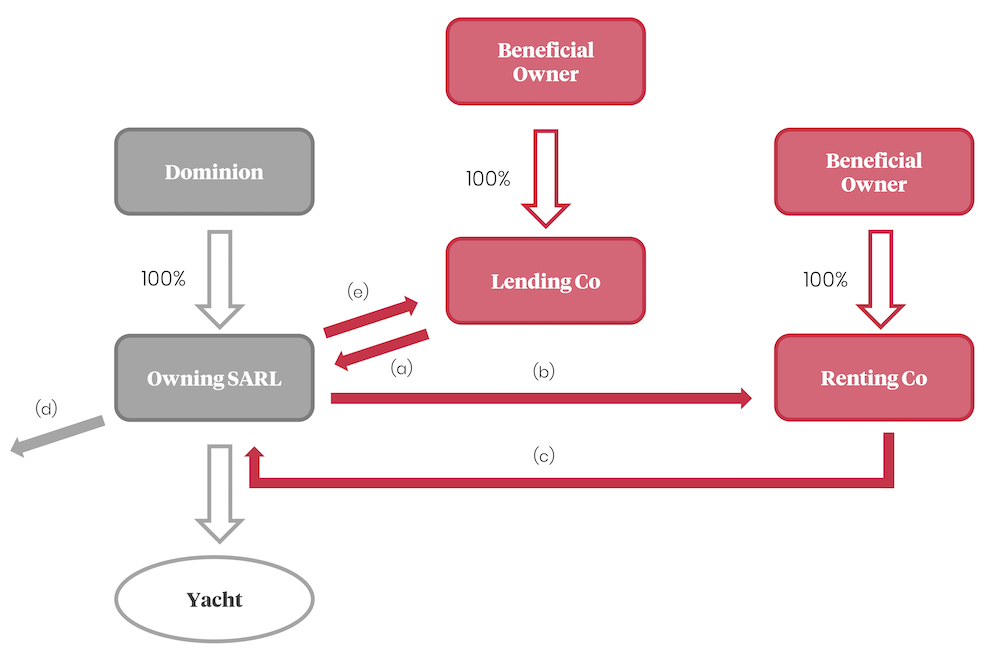

See below for a schematic of the Monaco VAT deferment solution or, alternatively, click here for a fuller description of how the Monegasque solution operates.

(a) Loan from Lending Company to Owning SARL to purchase the Yacht

(a) Loan from Lending Company to Owning SARL to purchase the Yacht

(b) Bareboat charter of Yacht from Owning SARL (Rentor) to Renting Co (Rentee)

(c) Rent payments from Renting Co to Owning SARL

(d) VAT payments from Owning SARL to Monaco VAT Office

(e) Loan repayments from Owning SARL to Lending Company (Rent payments less VAT)

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek