Brokerage: A year in review

The Superyacht Agency takes a closer look at 2021's brokerage performance…

With various reports lauding a record-breaking year for the brokerage market, The Superyacht Agency analyses 2021’s performance in line with years gone by in order to highlight the various ways that 2021 proved to be a unique year by recent standards. Perhaps of greatest note is not necessarily the unitary performance of the market, but the gross financial difference between 2020 and 2021.

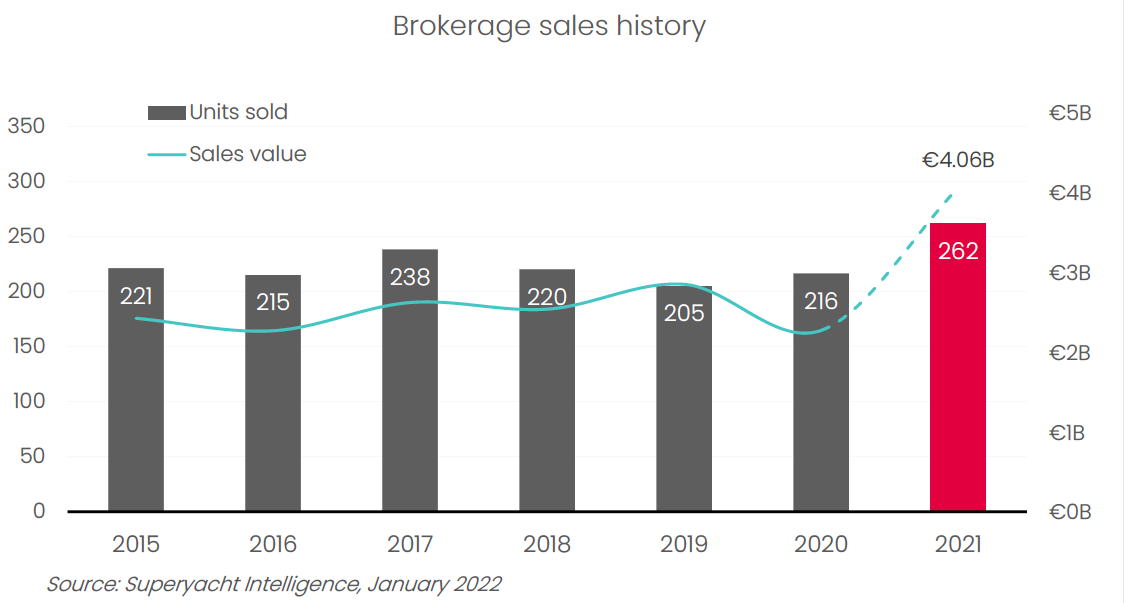

What is immediately noticeable from the first graph is that, at least in recent years, the brokerage market had reached an equilibrium of sorts, with sales performances from year to year not varying hugely. Indeed, the largest jump from year to year was a 23 sales increase between 2016 and 2017. By contrast, between 2020 and 2021 sales increased by 46.

The easiest thing would be to dismiss the leap in sales as being exaggerated by a poor COVID-impacted year in 2020. However, the graph clearly shows that, in actuality, 2020 was a relatively strong year. Furthermore, 2021 outperformed any year analysed herein, with various market commentators throughout the year explaining that sales figures were returning to pre-2008 levels.

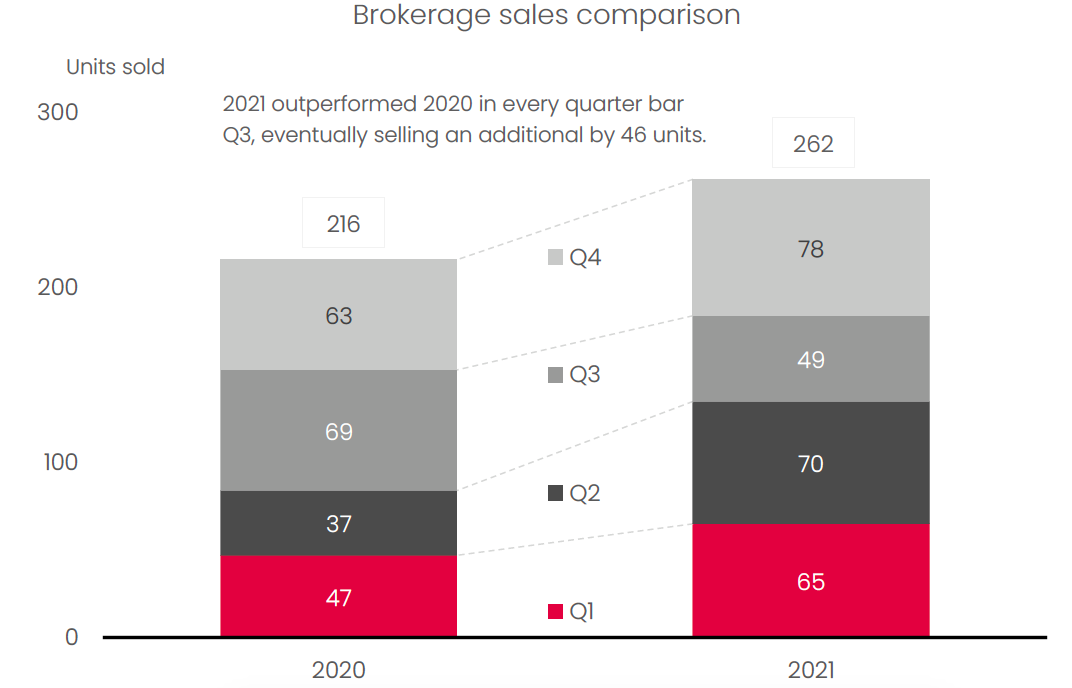

Figure 2 showcases a direct quarterly comparison between 2020 and 2021 with 2021 outperforming the previous year in all but the third quarter. While 2021 was also impacted by COVID restrictions, the restrictions throughout the year were less severe than 2020 and, as a result, many owners and/or potential buyers were using their vessels or chartering others, which may go some way towards explaining why there were fewer deals done in Q3 2021 than in 2020. After nearly two years of limited available yachting time, it is absolutely no wonder that sales decreased in the peak Mediterranean months. The most productive period for sales in 2021 proved to be Q4 with 78 sales completed.

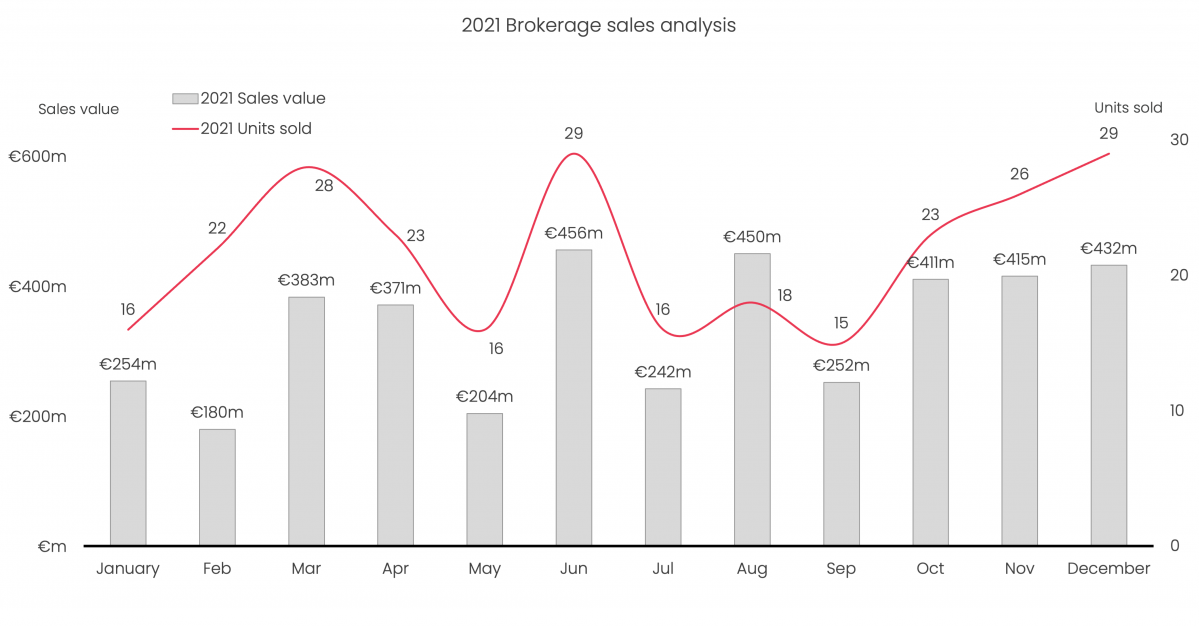

While Q4 proved to be the most prolific period of the year in terms of total sales and overall sales value, the best month for sales was in fact June with 29 superyachts sold with a combined value of €456m. By contrast, February was the least valuable month, albeit with a relatively high number of sales. In February, the average sales value was below €1million.

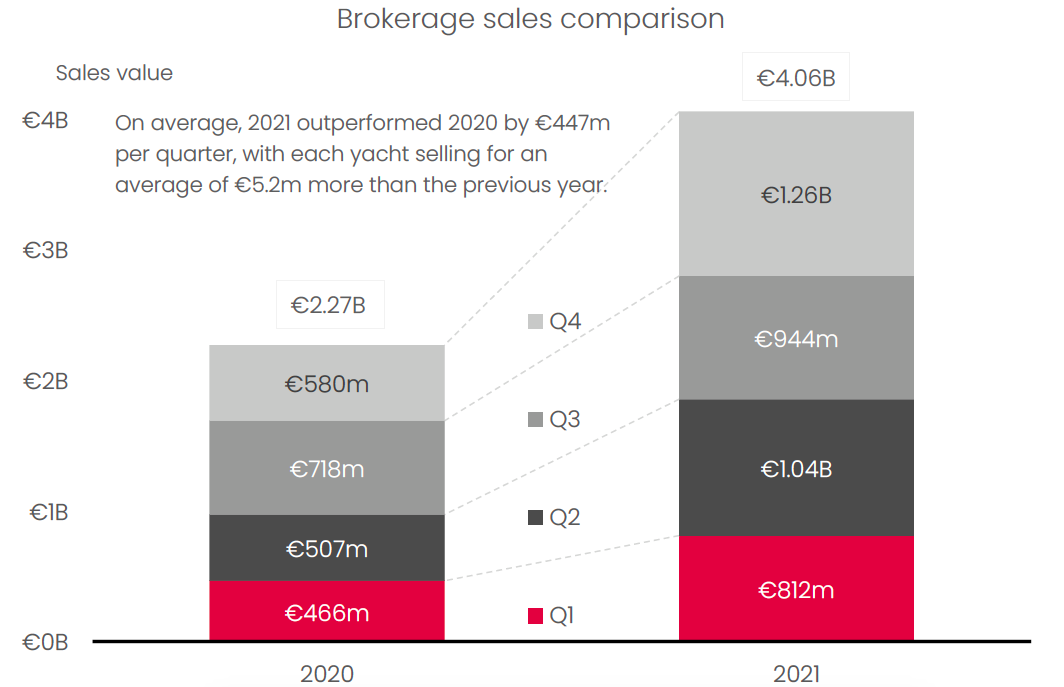

Perhaps of greater importance than the number of sales is the leap in total sales values. While in terms of units the market grew by 46 sales, the total sales value of the transactions almost doubled growing from €2.27billion to €4.06billion.

Perhaps of greater importance than the number of sales is the leap in total sales values. While in terms of units the market grew by 46 sales, the total sales value of the transactions almost doubled growing from €2.27billion to €4.06billion.

It could be argued that the relatively low total sales value in 2020 was exacerbated by the arrival of a number of stressed sales on the market as a result of the initial impact of COVID and the uncertainty it caused. In 2020 the average sales price was 10.5m, whereas in 2021 the average sales price grew to 15.6m. As Jonathan Beckett, CEO of Burgess, explained earlier in the week: “…as it stands prices are sensible. There is no more COVID pricing, you can’t go out and find cheap deals for excellent superyachts but, equally, I don’t think prices are overinflated by the demand at the moment. Prices seem fair, which is terrific.”

The year gone proved to be a bumper period for superyacht brokerage. Many of the industry’s most renowned market commentators are predicting that sales will remain strong in 2022. However, all have also warned about the potential impact of a lack of quality supply within the most desirable size ranges and brands, which may end up having an impact on pricing, potentially swaying the market away from the parity that Beckett described.

The data used herein only represents the surface of the data available to The Superyacht Agency and should only serve as an example of what can be provided through its consultative services. Every graph and metric can be broken down and analysed in a number of different ways by including size or ranges of size, brokerage house, location of sale, migratory data to determine where the vessels went post and much more. To find out more about The Superyacht Agency's consultative offering, click here.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Nautor Swan reflects

Giovanni Pomati, CEO of Nautor Group, considers the last two years and the future of sailing yachts

Fleet

Fasten your seatbelts

Jonathan Beckett, CEO of Burgess, considers the potential for 2022 across the market's three core buyer markets

Business

Introducing NFTs to the superyacht community

Andrew Grant Super, managing director of Berkeley-Rand, is paving the way for superyachts and NFTs

Owner

Darwin 106 Uptight successfully launched

Cantiere delle Marche announces the launch of their new explorer yacht Uptight

Fleet

Editors’ Roundtable

In a departure from standard practice, it was our editors who were under the microscope this time

Business

Related news

Nautor Swan reflects

3 years ago

Fasten your seatbelts

3 years ago

Introducing NFTs to the superyacht community

3 years ago

Darwin 106 Uptight successfully launched

3 years ago

Editors’ Roundtable

3 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek